-

The Millionaire Next Door

- The Surprising Secrets of America's Rich

- Narrated by: Cotter Smith

- Length: 8 hrs and 16 mins

Failed to add items

Add to Cart failed.

Add to Wish List failed.

Remove from wishlist failed.

Adding to library failed

Follow podcast failed

Unfollow podcast failed

Prime members: New to Audible?

Prime members: New to Audible?Get 2 free audiobooks during trial.

Buy for $18.74

No default payment method selected.

We are sorry. We are not allowed to sell this product with the selected payment method

Listeners also enjoyed...

-

The Next Millionaire Next Door

- Enduring Strategies for Building Wealth

- By: Sarah Stanley Fallaw, Thomas J. Stanley

- Narrated by: Stephen Wojtas

- Length: 7 hrs and 11 mins

- Unabridged

-

Overall4.5 out of 5 stars 707

-

Performance4.5 out of 5 stars 574

-

Story4.5 out of 5 stars 570

Over the past 40 years, Tom Stanley and his daughter Sarah Stanley Fallaw have been involved in research examining how self-made, economically successful Americans became that way. Despite the publication of The Millionaire Next Door, The Millionaire Mind, and others, myths about wealth in America still abound. Government officials, journalists, and many American still tend to confuse income with wealth.

-

3 out of 5 stars

-

Not Much New

- By Amazon Customer on 01-26-20

By: Sarah Stanley Fallaw, and others

-

Secrets of the Millionaire Mind

- Mastering the Inner Game of Wealth

- By: T. Harv Eker

- Narrated by: Charles Constant

- Length: 5 hrs and 10 mins

- Unabridged

-

Overall5 out of 5 stars 10,745

-

Performance5 out of 5 stars 9,038

-

Story5 out of 5 stars 8,998

Have you ever wondered why some people seem to get rich easily while others are destined for lives of financial struggle? Is the difference found in their education, intelligence, skills, timing, work habits, contacts, luck, or choice of jobs, businesses, or investments? The shocking answer is: none of the above! In his groundbreaking Secrets of the Millionaire Mind, T. Harv Eker states, "Give me five minutes, and I can predict your financial future for the rest of your life!"

-

3 out of 5 stars

-

Good book, too much adversiting

- By Guilherme on 08-17-19

By: T. Harv Eker

-

The Psychology of Money

- Timeless Lessons on Wealth, Greed, and Happiness

- By: Morgan Housel

- Narrated by: Chris Hill

- Length: 5 hrs and 54 mins

- Unabridged

-

Overall5 out of 5 stars 21,478

-

Performance5 out of 5 stars 17,832

-

Story4.5 out of 5 stars 17,742

Money - investing, personal finance, and business decisions - is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together. In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money.

-

3 out of 5 stars

-

Could be summarized in one sentence

- By Alex on 05-30-21

By: Morgan Housel

-

I Will Teach You to Be Rich

- No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)

- By: Ramit Sethi

- Narrated by: Ramit Sethi

- Length: 12 hrs and 8 mins

- Unabridged

-

Overall4.5 out of 5 stars 9,540

-

Performance5 out of 5 stars 8,028

-

Story4.5 out of 5 stars 7,943

Buy as many lattes as you want. Spend extravagantly on the things you love. Live your rich life instead of tracking every last expense with Ramit Sethi’s simple, powerful, and effective six-week program for gaining control over your finances. This isn’t typical advice from a money expert. In this completely updated second edition, Ramit teaches you how to choose long-term investments and the right bank accounts. With his characteristic no-BS perspective, he shows how to squeeze every hidden benefit out of your credit cards.

-

3 out of 5 stars

-

Repetitive - should be retitled.

- By Truth on 06-20-19

By: Ramit Sethi

-

The Simple Path to Wealth

- Your Road Map to Financial Independence and a Rich, Free Life

- By: JL Collins

- Narrated by: JL Collins, Peter Adeney

- Length: 6 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 9,305

-

Performance5 out of 5 stars 7,862

-

Story5 out of 5 stars 7,796

This book grew out of a series of letters to my daughter concerning various things - mostly about money and investing - she was not yet quite ready to hear. Since money is the single most powerful tool we have for navigating this complex world we've created, understanding it is critical.

-

1 out of 5 stars

-

Misleading, heavily biased

- By Cody Peralta on 07-19-19

By: JL Collins

-

The Millionaire Mind

- By: Thomas J. Stanley Ph.D., William D. Danko Ph.D.

- Narrated by: Cotter Smith

- Length: 12 hrs and 20 mins

- Unabridged

-

Overall4.5 out of 5 stars 3,012

-

Performance4.5 out of 5 stars 2,271

-

Story4.5 out of 5 stars 2,257

To become a millionaire, you have to think like one. The Millionaire Mind shows you how. Also available: The Millionaire Next Door.

-

2 out of 5 stars

-

No Millionaire Next Door

- By Sean on 02-01-03

By: Thomas J. Stanley Ph.D., and others

-

The Next Millionaire Next Door

- Enduring Strategies for Building Wealth

- By: Sarah Stanley Fallaw, Thomas J. Stanley

- Narrated by: Stephen Wojtas

- Length: 7 hrs and 11 mins

- Unabridged

-

Overall4.5 out of 5 stars 707

-

Performance4.5 out of 5 stars 574

-

Story4.5 out of 5 stars 570

Over the past 40 years, Tom Stanley and his daughter Sarah Stanley Fallaw have been involved in research examining how self-made, economically successful Americans became that way. Despite the publication of The Millionaire Next Door, The Millionaire Mind, and others, myths about wealth in America still abound. Government officials, journalists, and many American still tend to confuse income with wealth.

-

3 out of 5 stars

-

Not Much New

- By Amazon Customer on 01-26-20

By: Sarah Stanley Fallaw, and others

-

Secrets of the Millionaire Mind

- Mastering the Inner Game of Wealth

- By: T. Harv Eker

- Narrated by: Charles Constant

- Length: 5 hrs and 10 mins

- Unabridged

-

Overall5 out of 5 stars 10,745

-

Performance5 out of 5 stars 9,038

-

Story5 out of 5 stars 8,998

Have you ever wondered why some people seem to get rich easily while others are destined for lives of financial struggle? Is the difference found in their education, intelligence, skills, timing, work habits, contacts, luck, or choice of jobs, businesses, or investments? The shocking answer is: none of the above! In his groundbreaking Secrets of the Millionaire Mind, T. Harv Eker states, "Give me five minutes, and I can predict your financial future for the rest of your life!"

-

3 out of 5 stars

-

Good book, too much adversiting

- By Guilherme on 08-17-19

By: T. Harv Eker

-

The Psychology of Money

- Timeless Lessons on Wealth, Greed, and Happiness

- By: Morgan Housel

- Narrated by: Chris Hill

- Length: 5 hrs and 54 mins

- Unabridged

-

Overall5 out of 5 stars 21,478

-

Performance5 out of 5 stars 17,832

-

Story4.5 out of 5 stars 17,742

Money - investing, personal finance, and business decisions - is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together. In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money.

-

3 out of 5 stars

-

Could be summarized in one sentence

- By Alex on 05-30-21

By: Morgan Housel

-

I Will Teach You to Be Rich

- No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)

- By: Ramit Sethi

- Narrated by: Ramit Sethi

- Length: 12 hrs and 8 mins

- Unabridged

-

Overall4.5 out of 5 stars 9,540

-

Performance5 out of 5 stars 8,028

-

Story4.5 out of 5 stars 7,943

Buy as many lattes as you want. Spend extravagantly on the things you love. Live your rich life instead of tracking every last expense with Ramit Sethi’s simple, powerful, and effective six-week program for gaining control over your finances. This isn’t typical advice from a money expert. In this completely updated second edition, Ramit teaches you how to choose long-term investments and the right bank accounts. With his characteristic no-BS perspective, he shows how to squeeze every hidden benefit out of your credit cards.

-

3 out of 5 stars

-

Repetitive - should be retitled.

- By Truth on 06-20-19

By: Ramit Sethi

-

The Simple Path to Wealth

- Your Road Map to Financial Independence and a Rich, Free Life

- By: JL Collins

- Narrated by: JL Collins, Peter Adeney

- Length: 6 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 9,305

-

Performance5 out of 5 stars 7,862

-

Story5 out of 5 stars 7,796

This book grew out of a series of letters to my daughter concerning various things - mostly about money and investing - she was not yet quite ready to hear. Since money is the single most powerful tool we have for navigating this complex world we've created, understanding it is critical.

-

1 out of 5 stars

-

Misleading, heavily biased

- By Cody Peralta on 07-19-19

By: JL Collins

-

The Millionaire Mind

- By: Thomas J. Stanley Ph.D., William D. Danko Ph.D.

- Narrated by: Cotter Smith

- Length: 12 hrs and 20 mins

- Unabridged

-

Overall4.5 out of 5 stars 3,012

-

Performance4.5 out of 5 stars 2,271

-

Story4.5 out of 5 stars 2,257

To become a millionaire, you have to think like one. The Millionaire Mind shows you how. Also available: The Millionaire Next Door.

-

2 out of 5 stars

-

No Millionaire Next Door

- By Sean on 02-01-03

By: Thomas J. Stanley Ph.D., and others

-

The Little Book of Common Sense Investing

- The Only Way to Guarantee Your Fair Share of Stock Market Returns, 10th Anniversary Edition

- By: John C. Bogle

- Narrated by: L. J. Ganser

- Length: 5 hrs and 50 mins

- Unabridged

-

Overall4.5 out of 5 stars 2,547

-

Performance4.5 out of 5 stars 2,097

-

Story4.5 out of 5 stars 2,074

The Little Book of Common Sense Investing is the classic guide to getting smart about the market. Legendary mutual fund pioneer John C. Bogle reveals his key to getting more out of investing: low-cost index funds. Bogle describes the simplest and most effective investment strategy for building wealth over the long term: buy and hold, at very low cost, a mutual fund that tracks a broad stock market Index such as the S&P 500.

-

1 out of 5 stars

-

One star for every point this 5 hour book makes.

- By Matt on 01-31-19

By: John C. Bogle

-

The Intelligent Investor Rev Ed.

- By: Benjamin Graham

- Narrated by: Luke Daniels

- Length: 17 hrs and 48 mins

- Unabridged

-

Overall4.5 out of 5 stars 7,120

-

Performance4.5 out of 5 stars 5,870

-

Story4.5 out of 5 stars 5,816

The greatest investment advisor of the 20th century, Benjamin Graham taught and inspired people worldwide. Graham's philosophy of "value investing" - which shields investors from substantial error and teaches them to develop long-term strategies - has made The Intelligent Investor the stock market Bible ever since its original publication in 1949.

-

2 out of 5 stars

-

This book does not belong on audio

- By Craig on 09-12-17

By: Benjamin Graham

-

The 4-Hour Workweek: Escape 9-5, Live Anywhere, and Join the New Rich (Expanded and Updated)

- By: Timothy Ferriss

- Narrated by: Ray Porter

- Length: 13 hrs and 1 min

- Unabridged

-

Overall4.5 out of 5 stars 21,284

-

Performance4.5 out of 5 stars 17,369

-

Story4.5 out of 5 stars 17,257

This expanded edition includes dozens of practical tips and case studies from readers who have doubled their income, overcome common sticking points, and reinvented themselves using the original book. Also included are templates for eliminating email and negotiating with bosses and clients, how to apply lifestyle principles in unpredictable economic times, and the latest tools, tricks, and shortcuts for living like a diplomat or millionaire without being either.

-

2 out of 5 stars

-

Read with discernment

- By onlineshoppinggeek on 07-11-11

By: Timothy Ferriss

-

Atomic Habits

- An Easy & Proven Way to Build Good Habits & Break Bad Ones

- By: James Clear

- Narrated by: James Clear

- Length: 5 hrs and 35 mins

- Unabridged

-

Overall5 out of 5 stars 137,642

-

Performance5 out of 5 stars 112,609

-

Story5 out of 5 stars 111,555

No matter your goals, Atomic Habits offers a proven framework for improving - every day. James Clear, one of the world's leading experts on habit formation, reveals practical strategies that will teach you exactly how to form good habits, break bad ones, and master the tiny behaviors that lead to remarkable results. If you're having trouble changing your habits, the problem isn't you. The problem is your system. Bad habits repeat themselves again and again not because you don't want to change, but because you have the wrong system for change.

-

5 out of 5 stars

-

start here, if you are looking to achieve in life

- By NL on 10-22-18

By: James Clear

-

Money: Master the Game

- 7 Simple Steps to Financial Freedom

- By: Tony Robbins

- Narrated by: Tony Robbins, Jeremy Bobb

- Length: 21 hrs and 3 mins

- Unabridged

-

Overall4.5 out of 5 stars 14,838

-

Performance4.5 out of 5 stars 12,704

-

Story4.5 out of 5 stars 12,630

Tony Robbins has coached and inspired more than 50 million people from over 100 countries. More than four million people have attended his live events. Oprah Winfrey calls him "super-human". Now for the first time - in his first book in two decades - he's turned to the topic that vexes us all: How to secure financial freedom for ourselves and our families.

-

3 out of 5 stars

-

95% not spoken by Robbins

- By Chong Beng Lim on 11-19-14

By: Tony Robbins

-

Baby Steps Millionaires

- How Ordinary People Built Extraordinary Wealth - and How You Can Too

- By: Dave Ramsey

- Narrated by: Dave Ramsey

- Length: 4 hrs and 50 mins

- Unabridged

-

Overall4.5 out of 5 stars 2,766

-

Performance5 out of 5 stars 2,385

-

Story4.5 out of 5 stars 2,377

Most people know Dave Ramsey as the guy who did stupid with a lot of zeros on the end. He made his first million in his twenties—the wrong way—and then went bankrupt. That’s when he set out to learn what God had to say about managing money and building wealth. As a result, Dave developed the Ramsey Baby Steps and became a millionaire again—this time the right way. After three decades of guiding millions of others through the plan, the evidence is undeniable: the Baby Steps not only work for everyone, but they’re proven to work fast.

-

1 out of 5 stars

-

completely repetitive

- By Yari on 01-19-22

By: Dave Ramsey

-

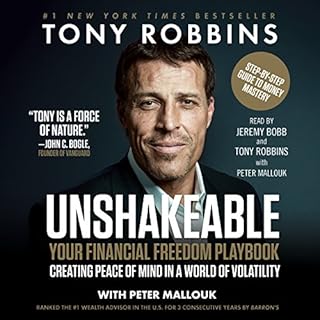

Unshakeable

- Your Financial Freedom Playbook

- By: Tony Robbins

- Narrated by: Tony Robbins, Jeremy Bobb

- Length: 7 hrs and 21 mins

- Unabridged

-

Overall4.5 out of 5 stars 9,447

-

Performance4.5 out of 5 stars 8,035

-

Story4.5 out of 5 stars 7,968

After interviewing 50 of the world's greatest financial minds and penning the number-one New York Times best seller Money: Master the Game, Tony Robbins returns with a step-by-step playbook, taking you on a journey to transform your financial life and accelerate your path to financial freedom. No matter your salary, your stage of life, or when you started, this book will provide the tools to help you achieve your financial goals more rapidly than you ever thought possible.

-

2 out of 5 stars

-

a one sentence summary....

- By Martin on 03-04-17

By: Tony Robbins

-

The Book on Rental Property Investing

- How to Create Wealth and Passive Income Through Smart Buy & Hold Real Estate Investing

- By: Brandon Turner

- Narrated by: Brandon Turner

- Length: 11 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 10,701

-

Performance4.5 out of 5 stars 9,042

-

Story5 out of 5 stars 8,947

Whether you're a beginner or looking for an advanced guide, this valuable book will help you learn how to create an profitable and practical plan, find incredible deals, analyze properties, build a team, finance rentals, and much more—everything you need to start making millions from your investments.

-

5 out of 5 stars

-

2017 Review

- By Hannah on 08-30-17

By: Brandon Turner

-

Your Money or Your Life

- 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence: Fully Revised and Updated for 2018

- By: Vicki Robin, Joe Dominguez, Mr. Money Mustache - foreword

- Narrated by: Vicki Robin

- Length: 11 hrs and 21 mins

- Unabridged

-

Overall4.5 out of 5 stars 2,515

-

Performance4.5 out of 5 stars 2,091

-

Story4.5 out of 5 stars 2,074

For more than 25 years, Your Money or Your Life has been considered the go-to book for taking back your life by changing your relationship with money. Hundreds of thousands of people have followed this nine-step program, learning to live more deliberately and meaningfully with Vicki Robin’s guidance. This fully revised and updated edition with a foreword by Mr. Money Mustache is the ultimate makeover of this best-selling classic, ensuring that its time-tested wisdom applies to people of all ages.

-

2 out of 5 stars

-

Not A Book About Finances

- By Tristan on 09-24-18

By: Vicki Robin, and others

-

The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime

- By: MJ DeMarco

- Narrated by: MJ DeMarco

- Length: 12 hrs and 46 mins

- Unabridged

-

Overall4.5 out of 5 stars 8,449

-

Performance4.5 out of 5 stars 7,280

-

Story4.5 out of 5 stars 7,248

Since you were old enough to hold a job, you've been hoodwinked to believe that wealth can be created by blindly trusting in the uncontrollable and unpredictable markets: the housing market, the stock market, and the job market. I call this soul-sucking, dream-stealing dogma "The Slowlane" - an impotent financial gamble that dubiously promises wealth in a wheelchair. For those who don't want a lifetime subscription to "settle-for-less", there is an alternative.

-

5 out of 5 stars

-

Excellent!

- By Iray007 on 09-22-15

By: MJ DeMarco

-

Stop Acting Rich

- And Start Living Like a Real Millionaire

- By: Thomas J. Stanley

- Narrated by: Fred Stella

- Length: 8 hrs and 26 mins

- Unabridged

-

Overall4.5 out of 5 stars 1,127

-

Performance4.5 out of 5 stars 889

-

Story4.5 out of 5 stars 883

Best-selling author of The Millionaire Next Door and The Millionaire Mind and leading authority on the wealthy, Dr. Thomas Stanley uncovers the truth that few people become rich by way of a high income, and even fewer high-income people are truly rich. The good news is that almost anyone can become wealthy - even without a super high income. Just stop acting...and instead start living like a rich person.

-

1 out of 5 stars

-

The Millionaire Next Door's Outtakes

- By Robin Olson Mayberry on 02-20-10

-

12 Months to $1 Million

- How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure Entrepreneur

- By: Ryan Daniel Moran

- Narrated by: Ryan Daniel Moran

- Length: 7 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 3,711

-

Performance5 out of 5 stars 3,200

-

Story5 out of 5 stars 3,184

By cutting out the noise and providing a clear and proven plan, this road map helps even brand-new entrepreneurs make decisions quickly, get their product up for sale, and launch it to a crowd that is ready and waiting to buy. This one-year plan will guide you through the three stages to your first $1 million: the Grind (months 0-4), the Growth (months 5-8), and the Gold (months 9-12). If your goal is to be a full-time entrepreneur, get ready for one chaotic, stressful, and rewarding year. If you have the guts to complete it, you will be the proud owner of a million-dollar business.

-

4 out of 5 stars

-

Good, but a Little Misleading

- By Chris Love on 11-28-20

Publisher's summary

Critic reviews

"The implication of The Millionaire Next Door is that nearly anybody with a steady job can amass a tidy fortune." (Forbes)

Featured Article: The 20 Best Finance Audiobooks for Amateurs and Masters Alike

Whether you’re a complete newbie or a seasoned investor, there’s sure to be a finance audiobook that will provide you not only with helpful, interesting information, but also with a listening experience sure to keep you engaged and focused. We’ve cultivated everything you need to get started, from long-term investing principles to increasing your overall net worth in big ways, with this list of the 20 best finance audiobooks from our catalog.

Related to this topic

-

I Will Teach You to Be Rich

- No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)

- By: Ramit Sethi

- Narrated by: Ramit Sethi

- Length: 12 hrs and 8 mins

- Unabridged

-

Overall4.5 out of 5 stars 9,540

-

Performance5 out of 5 stars 8,028

-

Story4.5 out of 5 stars 7,943

Buy as many lattes as you want. Spend extravagantly on the things you love. Live your rich life instead of tracking every last expense with Ramit Sethi’s simple, powerful, and effective six-week program for gaining control over your finances. This isn’t typical advice from a money expert. In this completely updated second edition, Ramit teaches you how to choose long-term investments and the right bank accounts. With his characteristic no-BS perspective, he shows how to squeeze every hidden benefit out of your credit cards.

-

3 out of 5 stars

-

Repetitive - should be retitled.

- By Truth on 06-20-19

By: Ramit Sethi

-

12 Months to $1 Million

- How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure Entrepreneur

- By: Ryan Daniel Moran

- Narrated by: Ryan Daniel Moran

- Length: 7 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 3,711

-

Performance5 out of 5 stars 3,200

-

Story5 out of 5 stars 3,184

By cutting out the noise and providing a clear and proven plan, this road map helps even brand-new entrepreneurs make decisions quickly, get their product up for sale, and launch it to a crowd that is ready and waiting to buy. This one-year plan will guide you through the three stages to your first $1 million: the Grind (months 0-4), the Growth (months 5-8), and the Gold (months 9-12). If your goal is to be a full-time entrepreneur, get ready for one chaotic, stressful, and rewarding year. If you have the guts to complete it, you will be the proud owner of a million-dollar business.

-

4 out of 5 stars

-

Good, but a Little Misleading

- By Chris Love on 11-28-20

-

The Simple Path to Wealth

- Your Road Map to Financial Independence and a Rich, Free Life

- By: JL Collins

- Narrated by: JL Collins, Peter Adeney

- Length: 6 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 9,305

-

Performance5 out of 5 stars 7,862

-

Story5 out of 5 stars 7,796

This book grew out of a series of letters to my daughter concerning various things - mostly about money and investing - she was not yet quite ready to hear. Since money is the single most powerful tool we have for navigating this complex world we've created, understanding it is critical.

-

1 out of 5 stars

-

Misleading, heavily biased

- By Cody Peralta on 07-19-19

By: JL Collins

-

The Creature from Jekyll Island

- A Second Look at the Federal Reserve

- By: G. Edward Griffin

- Narrated by: Mark Bramhall

- Length: 24 hrs and 21 mins

- Unabridged

-

Overall4.5 out of 5 stars 5,834

-

Performance5 out of 5 stars 5,144

-

Story4.5 out of 5 stars 5,141

This classic expose of the Fed has become one of the best-selling books in its category of all time. Where does money come from? Where does it go? Who makes it? The money magician's secrets are unveiled. Here is a close look at their mirrors and smoke machines, the pulleys, cogs, and wheels that create the grand illusion called money. A boring subject? Just wait. You'll be hooked in five minutes. It reads like a detective story - which it really is, but it's all true.

-

1 out of 5 stars

-

Lost confidence in author

- By Amazon Customer on 07-11-20

-

The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime

- By: MJ DeMarco

- Narrated by: MJ DeMarco

- Length: 12 hrs and 46 mins

- Unabridged

-

Overall4.5 out of 5 stars 8,449

-

Performance4.5 out of 5 stars 7,280

-

Story4.5 out of 5 stars 7,248

Since you were old enough to hold a job, you've been hoodwinked to believe that wealth can be created by blindly trusting in the uncontrollable and unpredictable markets: the housing market, the stock market, and the job market. I call this soul-sucking, dream-stealing dogma "The Slowlane" - an impotent financial gamble that dubiously promises wealth in a wheelchair. For those who don't want a lifetime subscription to "settle-for-less", there is an alternative.

-

5 out of 5 stars

-

Excellent!

- By Iray007 on 09-22-15

By: MJ DeMarco

-

Los secretos de la mente millonaria (Narración en Castellano) [Secrets of the Millionaire Mind]

- Domina el juego de la riqueza [Mastering the Inner Game of Wealth]

- By: T. Harv Eker

- Narrated by: Ivan Villanueva

- Length: 2 hrs and 17 mins

- Unabridged

-

Overall5 out of 5 stars 472

-

Performance5 out of 5 stars 404

-

Story5 out of 5 stars 408

El autor estaba en bancarrota, en solo dos años y medio se convirtió en millonario y construyó una de las más grandes firmas de consultoría para el éxito. Con sus enseñanzas ha tocado la vida de millones de personas. Este audiolibro te enseña a observar como piensas. Es un reto a tus ideas que te limitan, a los razonamientos que no te apoyan y a tus acciones con respecto al dinero.

-

3 out of 5 stars

-

El libro está bien, pero ES VERSION RESUMIDA

- By alexnvlp on 08-24-23

By: T. Harv Eker

-

I Will Teach You to Be Rich

- No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)

- By: Ramit Sethi

- Narrated by: Ramit Sethi

- Length: 12 hrs and 8 mins

- Unabridged

-

Overall4.5 out of 5 stars 9,540

-

Performance5 out of 5 stars 8,028

-

Story4.5 out of 5 stars 7,943

Buy as many lattes as you want. Spend extravagantly on the things you love. Live your rich life instead of tracking every last expense with Ramit Sethi’s simple, powerful, and effective six-week program for gaining control over your finances. This isn’t typical advice from a money expert. In this completely updated second edition, Ramit teaches you how to choose long-term investments and the right bank accounts. With his characteristic no-BS perspective, he shows how to squeeze every hidden benefit out of your credit cards.

-

3 out of 5 stars

-

Repetitive - should be retitled.

- By Truth on 06-20-19

By: Ramit Sethi

-

12 Months to $1 Million

- How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure Entrepreneur

- By: Ryan Daniel Moran

- Narrated by: Ryan Daniel Moran

- Length: 7 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 3,711

-

Performance5 out of 5 stars 3,200

-

Story5 out of 5 stars 3,184

By cutting out the noise and providing a clear and proven plan, this road map helps even brand-new entrepreneurs make decisions quickly, get their product up for sale, and launch it to a crowd that is ready and waiting to buy. This one-year plan will guide you through the three stages to your first $1 million: the Grind (months 0-4), the Growth (months 5-8), and the Gold (months 9-12). If your goal is to be a full-time entrepreneur, get ready for one chaotic, stressful, and rewarding year. If you have the guts to complete it, you will be the proud owner of a million-dollar business.

-

4 out of 5 stars

-

Good, but a Little Misleading

- By Chris Love on 11-28-20

-

The Simple Path to Wealth

- Your Road Map to Financial Independence and a Rich, Free Life

- By: JL Collins

- Narrated by: JL Collins, Peter Adeney

- Length: 6 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 9,305

-

Performance5 out of 5 stars 7,862

-

Story5 out of 5 stars 7,796

This book grew out of a series of letters to my daughter concerning various things - mostly about money and investing - she was not yet quite ready to hear. Since money is the single most powerful tool we have for navigating this complex world we've created, understanding it is critical.

-

1 out of 5 stars

-

Misleading, heavily biased

- By Cody Peralta on 07-19-19

By: JL Collins

-

The Creature from Jekyll Island

- A Second Look at the Federal Reserve

- By: G. Edward Griffin

- Narrated by: Mark Bramhall

- Length: 24 hrs and 21 mins

- Unabridged

-

Overall4.5 out of 5 stars 5,834

-

Performance5 out of 5 stars 5,144

-

Story4.5 out of 5 stars 5,141

This classic expose of the Fed has become one of the best-selling books in its category of all time. Where does money come from? Where does it go? Who makes it? The money magician's secrets are unveiled. Here is a close look at their mirrors and smoke machines, the pulleys, cogs, and wheels that create the grand illusion called money. A boring subject? Just wait. You'll be hooked in five minutes. It reads like a detective story - which it really is, but it's all true.

-

1 out of 5 stars

-

Lost confidence in author

- By Amazon Customer on 07-11-20

-

The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime

- By: MJ DeMarco

- Narrated by: MJ DeMarco

- Length: 12 hrs and 46 mins

- Unabridged

-

Overall4.5 out of 5 stars 8,449

-

Performance4.5 out of 5 stars 7,280

-

Story4.5 out of 5 stars 7,248

Since you were old enough to hold a job, you've been hoodwinked to believe that wealth can be created by blindly trusting in the uncontrollable and unpredictable markets: the housing market, the stock market, and the job market. I call this soul-sucking, dream-stealing dogma "The Slowlane" - an impotent financial gamble that dubiously promises wealth in a wheelchair. For those who don't want a lifetime subscription to "settle-for-less", there is an alternative.

-

5 out of 5 stars

-

Excellent!

- By Iray007 on 09-22-15

By: MJ DeMarco

-

Los secretos de la mente millonaria (Narración en Castellano) [Secrets of the Millionaire Mind]

- Domina el juego de la riqueza [Mastering the Inner Game of Wealth]

- By: T. Harv Eker

- Narrated by: Ivan Villanueva

- Length: 2 hrs and 17 mins

- Unabridged

-

Overall5 out of 5 stars 472

-

Performance5 out of 5 stars 404

-

Story5 out of 5 stars 408

El autor estaba en bancarrota, en solo dos años y medio se convirtió en millonario y construyó una de las más grandes firmas de consultoría para el éxito. Con sus enseñanzas ha tocado la vida de millones de personas. Este audiolibro te enseña a observar como piensas. Es un reto a tus ideas que te limitan, a los razonamientos que no te apoyan y a tus acciones con respecto al dinero.

-

3 out of 5 stars

-

El libro está bien, pero ES VERSION RESUMIDA

- By alexnvlp on 08-24-23

By: T. Harv Eker

-

Plan Your Year Like a Millionaire

- By: Rachel Rodgers

- Narrated by: Rachel Rodgers

- Length: 2 hrs

- Original Recording

-

Overall4.5 out of 5 stars 1,302

-

Performance4.5 out of 5 stars 1,259

-

Story4.5 out of 5 stars 1,258

Plan Like a Millionaire is part of a riveting three-part series, and it's all about elevating your game and setting goals like a seven-figure earner. In this wealth-inspiring listening journey, Rachel reveals the secrets of how to set goals, manage time wisely, build essential support systems, break free from financial constraints, and make savvy money decisions.

-

3 out of 5 stars

-

Feel Good Book, only

- By Maggie on 01-06-24

By: Rachel Rodgers

-

How to Day Trade for a Living

- A Beginner's Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology

- By: Andrew Aziz

- Narrated by: Kevin Foley

- Length: 6 hrs and 56 mins

- Unabridged

-

Overall4.5 out of 5 stars 1,318

-

Performance4.5 out of 5 stars 1,063

-

Story4.5 out of 5 stars 1,059

Very few careers can offer you the freedom, flexibility, and income that day trading does. As a day trader, you can live and work anywhere in the world. You can decide when to work and when not to work. You only answer to yourself. That is the life of the successful day trader. Many people aspire to it, but very few succeed. In the audiobook, I describe the fundamentals of day trading, explain how day trading is different from other styles of trading and investment, and elaborate on important trading strategies that many traders use every day.

-

3 out of 5 stars

-

Its a sales pitch

- By Xavier Foley on 02-08-18

By: Andrew Aziz

-

The Little Book of Common Sense Investing

- The Only Way to Guarantee Your Fair Share of Stock Market Returns, 10th Anniversary Edition

- By: John C. Bogle

- Narrated by: L. J. Ganser

- Length: 5 hrs and 50 mins

- Unabridged

-

Overall4.5 out of 5 stars 2,547

-

Performance4.5 out of 5 stars 2,097

-

Story4.5 out of 5 stars 2,074

The Little Book of Common Sense Investing is the classic guide to getting smart about the market. Legendary mutual fund pioneer John C. Bogle reveals his key to getting more out of investing: low-cost index funds. Bogle describes the simplest and most effective investment strategy for building wealth over the long term: buy and hold, at very low cost, a mutual fund that tracks a broad stock market Index such as the S&P 500.

-

1 out of 5 stars

-

One star for every point this 5 hour book makes.

- By Matt on 01-31-19

By: John C. Bogle

-

The Price We Pay

- What Broke American Health Care - and How to Fix It

- By: Marty Makary MD

- Narrated by: Marty Makary MD

- Length: 9 hrs and 29 mins

- Unabridged

-

Overall5 out of 5 stars 926

-

Performance5 out of 5 stars 805

-

Story5 out of 5 stars 799

One in five Americans now has medical debt in collections and rising health care costs today threaten every small business in America. Dr Makary, one of the nation's leading health care experts, travels across America and details why health care has become a bubble. Drawing from on-the-ground stories, his research and his own experience, The Price We Pay paints a vivid picture of price-gouging, middlemen and a series of elusive money games in need of a serious shake-up.

-

5 out of 5 stars

-

Very important book!

- By Wayne on 05-17-21

By: Marty Makary MD

-

The 1-Page Marketing Plan

- Get New Customers, Make More Money, And Stand Out From The Crowd

- By: Allan Dib

- Narrated by: Joel Richards

- Length: 6 hrs and 31 mins

- Unabridged

-

Overall5 out of 5 stars 5,085

-

Performance5 out of 5 stars 4,380

-

Story5 out of 5 stars 4,325

To build a successful business, you need to stop doing random acts of marketing and start following a reliable plan for rapid business growth. Traditionally, creating a marketing plan has been a difficult and time-consuming process, which is why it often doesn’t get done.

-

1 out of 5 stars

-

You Need to buy Book to get key info

- By Rosie's mom on 10-23-18

By: Allan Dib

-

Million-Dollar Habits

- By: Rachel Rodgers

- Narrated by: Rachel Rodgers

- Length: 2 hrs and 3 mins

- Original Recording

-

Overall4 out of 5 stars 480

-

Performance4.5 out of 5 stars 462

-

Story4 out of 5 stars 462

Rachel Rodgers, personal finance expert and author of the best-selling We Should All Be Millionaires, delivers yet again in her three-part Audible Originals series. In Million Dollar Habits, Rodgers puts forward the habits you would do well to adopt in order to generate wealth. And before she gets to those habits, she first encourages you to raise your financial goals.

-

3 out of 5 stars

-

Good foundational information.. ughh

- By JAR on 03-28-24

By: Rachel Rodgers

People who viewed this also viewed...

-

The Next Millionaire Next Door

- Enduring Strategies for Building Wealth

- By: Sarah Stanley Fallaw, Thomas J. Stanley

- Narrated by: Stephen Wojtas

- Length: 7 hrs and 11 mins

- Unabridged

-

Overall4.5 out of 5 stars 707

-

Performance4.5 out of 5 stars 574

-

Story4.5 out of 5 stars 570

Over the past 40 years, Tom Stanley and his daughter Sarah Stanley Fallaw have been involved in research examining how self-made, economically successful Americans became that way. Despite the publication of The Millionaire Next Door, The Millionaire Mind, and others, myths about wealth in America still abound. Government officials, journalists, and many American still tend to confuse income with wealth.

-

3 out of 5 stars

-

Not Much New

- By Amazon Customer on 01-26-20

By: Sarah Stanley Fallaw, and others

-

The Millionaire Mind

- By: Thomas J. Stanley Ph.D., William D. Danko Ph.D.

- Narrated by: Cotter Smith

- Length: 12 hrs and 20 mins

- Unabridged

-

Overall4.5 out of 5 stars 3,012

-

Performance4.5 out of 5 stars 2,271

-

Story4.5 out of 5 stars 2,257

To become a millionaire, you have to think like one. The Millionaire Mind shows you how. Also available: The Millionaire Next Door.

-

2 out of 5 stars

-

No Millionaire Next Door

- By Sean on 02-01-03

By: Thomas J. Stanley Ph.D., and others

-

The Simple Path to Wealth

- Your Road Map to Financial Independence and a Rich, Free Life

- By: JL Collins

- Narrated by: JL Collins, Peter Adeney

- Length: 6 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 9,305

-

Performance5 out of 5 stars 7,862

-

Story5 out of 5 stars 7,796

This book grew out of a series of letters to my daughter concerning various things - mostly about money and investing - she was not yet quite ready to hear. Since money is the single most powerful tool we have for navigating this complex world we've created, understanding it is critical.

-

1 out of 5 stars

-

Misleading, heavily biased

- By Cody Peralta on 07-19-19

By: JL Collins

-

Stop Acting Rich

- And Start Living Like a Real Millionaire

- By: Thomas J. Stanley

- Narrated by: Fred Stella

- Length: 8 hrs and 26 mins

- Unabridged

-

Overall4.5 out of 5 stars 1,127

-

Performance4.5 out of 5 stars 889

-

Story4.5 out of 5 stars 883

Best-selling author of The Millionaire Next Door and The Millionaire Mind and leading authority on the wealthy, Dr. Thomas Stanley uncovers the truth that few people become rich by way of a high income, and even fewer high-income people are truly rich. The good news is that almost anyone can become wealthy - even without a super high income. Just stop acting...and instead start living like a rich person.

-

1 out of 5 stars

-

The Millionaire Next Door's Outtakes

- By Robin Olson Mayberry on 02-20-10

-

Secrets of the Millionaire Mind

- Mastering the Inner Game of Wealth

- By: T. Harv Eker

- Narrated by: Charles Constant

- Length: 5 hrs and 10 mins

- Unabridged

-

Overall5 out of 5 stars 10,745

-

Performance5 out of 5 stars 9,038

-

Story5 out of 5 stars 8,998

Have you ever wondered why some people seem to get rich easily while others are destined for lives of financial struggle? Is the difference found in their education, intelligence, skills, timing, work habits, contacts, luck, or choice of jobs, businesses, or investments? The shocking answer is: none of the above! In his groundbreaking Secrets of the Millionaire Mind, T. Harv Eker states, "Give me five minutes, and I can predict your financial future for the rest of your life!"

-

3 out of 5 stars

-

Good book, too much adversiting

- By Guilherme on 08-17-19

By: T. Harv Eker

-

The Psychology of Money

- Timeless Lessons on Wealth, Greed, and Happiness

- By: Morgan Housel

- Narrated by: Chris Hill

- Length: 5 hrs and 54 mins

- Unabridged

-

Overall5 out of 5 stars 21,478

-

Performance5 out of 5 stars 17,832

-

Story4.5 out of 5 stars 17,742

Money - investing, personal finance, and business decisions - is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together. In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money.

-

3 out of 5 stars

-

Could be summarized in one sentence

- By Alex on 05-30-21

By: Morgan Housel

-

The Next Millionaire Next Door

- Enduring Strategies for Building Wealth

- By: Sarah Stanley Fallaw, Thomas J. Stanley

- Narrated by: Stephen Wojtas

- Length: 7 hrs and 11 mins

- Unabridged

-

Overall4.5 out of 5 stars 707

-

Performance4.5 out of 5 stars 574

-

Story4.5 out of 5 stars 570

Over the past 40 years, Tom Stanley and his daughter Sarah Stanley Fallaw have been involved in research examining how self-made, economically successful Americans became that way. Despite the publication of The Millionaire Next Door, The Millionaire Mind, and others, myths about wealth in America still abound. Government officials, journalists, and many American still tend to confuse income with wealth.

-

3 out of 5 stars

-

Not Much New

- By Amazon Customer on 01-26-20

By: Sarah Stanley Fallaw, and others

-

The Millionaire Mind

- By: Thomas J. Stanley Ph.D., William D. Danko Ph.D.

- Narrated by: Cotter Smith

- Length: 12 hrs and 20 mins

- Unabridged

-

Overall4.5 out of 5 stars 3,012

-

Performance4.5 out of 5 stars 2,271

-

Story4.5 out of 5 stars 2,257

To become a millionaire, you have to think like one. The Millionaire Mind shows you how. Also available: The Millionaire Next Door.

-

2 out of 5 stars

-

No Millionaire Next Door

- By Sean on 02-01-03

By: Thomas J. Stanley Ph.D., and others

-

The Simple Path to Wealth

- Your Road Map to Financial Independence and a Rich, Free Life

- By: JL Collins

- Narrated by: JL Collins, Peter Adeney

- Length: 6 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 9,305

-

Performance5 out of 5 stars 7,862

-

Story5 out of 5 stars 7,796

This book grew out of a series of letters to my daughter concerning various things - mostly about money and investing - she was not yet quite ready to hear. Since money is the single most powerful tool we have for navigating this complex world we've created, understanding it is critical.

-

1 out of 5 stars

-

Misleading, heavily biased

- By Cody Peralta on 07-19-19

By: JL Collins

-

Stop Acting Rich

- And Start Living Like a Real Millionaire

- By: Thomas J. Stanley

- Narrated by: Fred Stella

- Length: 8 hrs and 26 mins

- Unabridged

-

Overall4.5 out of 5 stars 1,127

-

Performance4.5 out of 5 stars 889

-

Story4.5 out of 5 stars 883

Best-selling author of The Millionaire Next Door and The Millionaire Mind and leading authority on the wealthy, Dr. Thomas Stanley uncovers the truth that few people become rich by way of a high income, and even fewer high-income people are truly rich. The good news is that almost anyone can become wealthy - even without a super high income. Just stop acting...and instead start living like a rich person.

-

1 out of 5 stars

-

The Millionaire Next Door's Outtakes

- By Robin Olson Mayberry on 02-20-10

-

Secrets of the Millionaire Mind

- Mastering the Inner Game of Wealth

- By: T. Harv Eker

- Narrated by: Charles Constant

- Length: 5 hrs and 10 mins

- Unabridged

-

Overall5 out of 5 stars 10,745

-

Performance5 out of 5 stars 9,038

-

Story5 out of 5 stars 8,998

Have you ever wondered why some people seem to get rich easily while others are destined for lives of financial struggle? Is the difference found in their education, intelligence, skills, timing, work habits, contacts, luck, or choice of jobs, businesses, or investments? The shocking answer is: none of the above! In his groundbreaking Secrets of the Millionaire Mind, T. Harv Eker states, "Give me five minutes, and I can predict your financial future for the rest of your life!"

-

3 out of 5 stars

-

Good book, too much adversiting

- By Guilherme on 08-17-19

By: T. Harv Eker

-

The Psychology of Money

- Timeless Lessons on Wealth, Greed, and Happiness

- By: Morgan Housel

- Narrated by: Chris Hill

- Length: 5 hrs and 54 mins

- Unabridged

-

Overall5 out of 5 stars 21,478

-

Performance5 out of 5 stars 17,832

-

Story4.5 out of 5 stars 17,742

Money - investing, personal finance, and business decisions - is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together. In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money.

-

3 out of 5 stars

-

Could be summarized in one sentence

- By Alex on 05-30-21

By: Morgan Housel

-

I Will Teach You to Be Rich

- No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)

- By: Ramit Sethi

- Narrated by: Ramit Sethi

- Length: 12 hrs and 8 mins

- Unabridged

-

Overall4.5 out of 5 stars 9,540

-

Performance5 out of 5 stars 8,028

-

Story4.5 out of 5 stars 7,943

Buy as many lattes as you want. Spend extravagantly on the things you love. Live your rich life instead of tracking every last expense with Ramit Sethi’s simple, powerful, and effective six-week program for gaining control over your finances. This isn’t typical advice from a money expert. In this completely updated second edition, Ramit teaches you how to choose long-term investments and the right bank accounts. With his characteristic no-BS perspective, he shows how to squeeze every hidden benefit out of your credit cards.

-

3 out of 5 stars

-

Repetitive - should be retitled.

- By Truth on 06-20-19

By: Ramit Sethi

-

Unshakeable

- Your Financial Freedom Playbook

- By: Tony Robbins

- Narrated by: Tony Robbins, Jeremy Bobb

- Length: 7 hrs and 21 mins

- Unabridged

-

Overall4.5 out of 5 stars 9,447

-

Performance4.5 out of 5 stars 8,035

-

Story4.5 out of 5 stars 7,968

After interviewing 50 of the world's greatest financial minds and penning the number-one New York Times best seller Money: Master the Game, Tony Robbins returns with a step-by-step playbook, taking you on a journey to transform your financial life and accelerate your path to financial freedom. No matter your salary, your stage of life, or when you started, this book will provide the tools to help you achieve your financial goals more rapidly than you ever thought possible.

-

2 out of 5 stars

-

a one sentence summary....

- By Martin on 03-04-17

By: Tony Robbins

-

The Little Book of Common Sense Investing

- The Only Way to Guarantee Your Fair Share of Stock Market Returns, 10th Anniversary Edition

- By: John C. Bogle

- Narrated by: L. J. Ganser

- Length: 5 hrs and 50 mins

- Unabridged

-

Overall4.5 out of 5 stars 2,547

-

Performance4.5 out of 5 stars 2,097

-

Story4.5 out of 5 stars 2,074

The Little Book of Common Sense Investing is the classic guide to getting smart about the market. Legendary mutual fund pioneer John C. Bogle reveals his key to getting more out of investing: low-cost index funds. Bogle describes the simplest and most effective investment strategy for building wealth over the long term: buy and hold, at very low cost, a mutual fund that tracks a broad stock market Index such as the S&P 500.

-

1 out of 5 stars

-

One star for every point this 5 hour book makes.

- By Matt on 01-31-19

By: John C. Bogle

-

The Intelligent Investor Rev Ed.

- By: Benjamin Graham

- Narrated by: Luke Daniels

- Length: 17 hrs and 48 mins

- Unabridged

-

Overall4.5 out of 5 stars 7,120

-

Performance4.5 out of 5 stars 5,870

-

Story4.5 out of 5 stars 5,816

The greatest investment advisor of the 20th century, Benjamin Graham taught and inspired people worldwide. Graham's philosophy of "value investing" - which shields investors from substantial error and teaches them to develop long-term strategies - has made The Intelligent Investor the stock market Bible ever since its original publication in 1949.

-

2 out of 5 stars

-

This book does not belong on audio

- By Craig on 09-12-17

By: Benjamin Graham

-

Your Money or Your Life

- 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence: Fully Revised and Updated for 2018

- By: Vicki Robin, Joe Dominguez, Mr. Money Mustache - foreword

- Narrated by: Vicki Robin

- Length: 11 hrs and 21 mins

- Unabridged

-

Overall4.5 out of 5 stars 2,515

-

Performance4.5 out of 5 stars 2,091

-

Story4.5 out of 5 stars 2,074

For more than 25 years, Your Money or Your Life has been considered the go-to book for taking back your life by changing your relationship with money. Hundreds of thousands of people have followed this nine-step program, learning to live more deliberately and meaningfully with Vicki Robin’s guidance. This fully revised and updated edition with a foreword by Mr. Money Mustache is the ultimate makeover of this best-selling classic, ensuring that its time-tested wisdom applies to people of all ages.

-

2 out of 5 stars

-

Not A Book About Finances

- By Tristan on 09-24-18

By: Vicki Robin, and others

-

The Millionaire Next Door

- The Surprising Secrets of America's Rich

- By: Thomas J. Stanley Ph.D., William D. Danko Ph.D.

- Narrated by: Cotter Smith

- Length: 2 hrs and 24 mins

- Abridged

-

Overall4.5 out of 5 stars 511

-

Performance4.5 out of 5 stars 300

-

Story4.5 out of 5 stars 305

Listen to the incredible national best seller that is changing people's lives - and increasing their net worth. Also available: The Millionaire Mind.

-

1 out of 5 stars

-

A rather sad outlook on life and money

- By Justin on 10-09-04

By: Thomas J. Stanley Ph.D., and others

-

The Total Money Makeover Updated and Expanded

- A Proven Plan for Financial Peace

- By: Dave Ramsey

- Narrated by: Dave Ramsey

- Length: 7 hrs and 50 mins

- Unabridged

-

Overall5 out of 5 stars 251

-

Performance5 out of 5 stars 236

-

Story5 out of 5 stars 236

By now, you've already heard all of the nutty get-rich-quick schemes and the fiscal diet fads that leave you with a lot of quirky ideas but not a penny in your pocket. If you're tired of the lies and sick of the false promises, Dave is here to provide practical long-term help. The Total Money Makeover is the simplest, most straightforward game plan for completely changing your finances. And, best of all, these principles are based on results, not pie-in-the-sky fantasies. This is the financial reset you've been looking for.

-

5 out of 5 stars

-

Easy to Understand Plan

- By Melinda E. on 06-06-24

By: Dave Ramsey

-

The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime

- By: MJ DeMarco

- Narrated by: MJ DeMarco

- Length: 12 hrs and 46 mins

- Unabridged

-

Overall4.5 out of 5 stars 8,449

-

Performance4.5 out of 5 stars 7,280

-

Story4.5 out of 5 stars 7,248

Since you were old enough to hold a job, you've been hoodwinked to believe that wealth can be created by blindly trusting in the uncontrollable and unpredictable markets: the housing market, the stock market, and the job market. I call this soul-sucking, dream-stealing dogma "The Slowlane" - an impotent financial gamble that dubiously promises wealth in a wheelchair. For those who don't want a lifetime subscription to "settle-for-less", there is an alternative.

-

5 out of 5 stars

-

Excellent!

- By Iray007 on 09-22-15

By: MJ DeMarco

-

The Richest Man in Babylon

- By: George S. Clason

- Narrated by: Grover Gardner

- Length: 4 hrs and 4 mins

- Unabridged

-

Overall4.5 out of 5 stars 26,477

-

Performance4.5 out of 5 stars 22,491

-

Story4.5 out of 5 stars 22,467

A modern day classic, The Richest Man in Babylon dispenses financial advice through a collection of parables set in ancient Babylon. These famous "Babylonian parables" offer an understanding of - and solution to - a lifetime's worth of personal financial problems, and hold the secrets to acquiring money, keeping money, and earning more money.

-

5 out of 5 stars

-

Better Financial Control, Better Quality of Life

- By will on 08-31-14

By: George S. Clason

-

12 Months to $1 Million

- How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure Entrepreneur

- By: Ryan Daniel Moran

- Narrated by: Ryan Daniel Moran

- Length: 7 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 3,711

-

Performance5 out of 5 stars 3,200

-

Story5 out of 5 stars 3,184

By cutting out the noise and providing a clear and proven plan, this road map helps even brand-new entrepreneurs make decisions quickly, get their product up for sale, and launch it to a crowd that is ready and waiting to buy. This one-year plan will guide you through the three stages to your first $1 million: the Grind (months 0-4), the Growth (months 5-8), and the Gold (months 9-12). If your goal is to be a full-time entrepreneur, get ready for one chaotic, stressful, and rewarding year. If you have the guts to complete it, you will be the proud owner of a million-dollar business.

-

4 out of 5 stars

-

Good, but a Little Misleading

- By Chris Love on 11-28-20

-

Networking with Millionaires...and Their Advisors

- By: Thomas J. Stanley Ph.D.

- Narrated by: Thomas J. Stanley Ph.D.

- Length: 4 hrs and 34 mins

- Unabridged

-

Overall4 out of 5 stars 458

-

Performance4.5 out of 5 stars 261

-

Story4.5 out of 5 stars 260

In The Millionaire Next Door, best selling author Thomas Stanley identified the millionaires around you. In The Millionaire Mind, he told you how they think. Now, he tells you how to get their business.

-

5 out of 5 stars

-

Well Read, With Practical and Insightful Guidance

- By Keyvan on 01-18-04

-

Money: Master the Game

- 7 Simple Steps to Financial Freedom

- By: Tony Robbins

- Narrated by: Tony Robbins, Jeremy Bobb

- Length: 21 hrs and 3 mins

- Unabridged

-

Overall4.5 out of 5 stars 14,838

-

Performance4.5 out of 5 stars 12,704

-

Story4.5 out of 5 stars 12,630

Tony Robbins has coached and inspired more than 50 million people from over 100 countries. More than four million people have attended his live events. Oprah Winfrey calls him "super-human". Now for the first time - in his first book in two decades - he's turned to the topic that vexes us all: How to secure financial freedom for ourselves and our families.

-

3 out of 5 stars

-

95% not spoken by Robbins

- By Chong Beng Lim on 11-19-14

By: Tony Robbins

What listeners say about The Millionaire Next Door

Average customer ratingsReviews - Please select the tabs below to change the source of reviews.

-

Overall5 out of 5 stars

-

Performance4 out of 5 stars

-

Story5 out of 5 stars

- Pixel

- 01-03-12

Eye opening findings and helpful insights

I learned quite a bit with the first listen that I've started a repeat.

The findings presented in the book were eye opening to me. Before I also had that misconception of who the wealthy really are. I thought the people who drive luxury cars and wear expensive watches were rich. But according to the authors' definition of wealth the rich don't even spend $500 for a watch and would buy used cars.

The stats might sound a bit dry but provide context to the analysis. The last part of the book can be helpful to those who look for ways to target the wealthy.

Definitely one of the books I read in 2011 that had an impact on me.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Justin

- 06-04-15

Mind Shift

This book will certainly change the course of my life and how I think about money and wealth!

I highly recommend!

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall4 out of 5 stars

-

Performance3 out of 5 stars

-

Story4 out of 5 stars

- mario

- 03-31-16

if u plan to make more than avg money must read!

great information but some stuff really boring especially in the beginning. the stuff about gifts and spoiling family is amazing info. if u plan to make more than average money through job or business u must read/listen to this book. I listen on long road trips. kept me awake.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Randy

- 12-05-11

Excellent Story, that tells a lot about the USA

What did you love best about The Millionaire Next Door?

I love knowing that the reason Millionaires become so is because they don't buy status artifacts. I also now know that providing too much support for your children is worse than not supporting them at all

What did you like best about this story?

The comparisons

Which character – as performed by Cotter Smith – was your favorite?

The doctors, the wealthy one and the status one.

Was this a book you wanted to listen to all in one sitting?

No I listened as I drove, I drive a lot.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance4 out of 5 stars

-

Story5 out of 5 stars

- Afiba

- 07-08-15

excellent and relevant

this book has given me tremendous confidence in my past and future actions toward building wealth.

removed the myths and solidified perspectives which are meaningful, practical and effective.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall4 out of 5 stars

- Rafa

- 10-29-16

I had to Google frugal

I'm only 26 so about 1/3 of the book was not relavent to me . but the other 2/3 was very interesting

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

- Macaulay

- 01-02-17

Very insightful.

Helped me put my financial goals in the forfront of my mind. Also was very motivating and thought provoking for what kind of lifestyle I want to live.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- V

- 01-01-18

Must Read for Wealth Economics!

This was a fantastic read - do yourself a favor and drink in this wisdom! This book did an amazing job of breaking down typically complex wealth building concepts, and turning it into bite sized applicable pieces. I never expected to learn about establishing wealth habits in children as well as myself! I get why this book has so many recommendations from people with the wealth results I want in life.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Kossi Ahouissi

- 10-31-17

Wow, just wow

If your plan is to become financially stable, you must read this book. I convinced myself to read it twice even though it's a fairly long one. Very good research!

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Amazon Customer

- 10-27-17

Mind opening

The book is a mind opener, you'll start being more frugal as the book teaches and your life might get better if yoy stick to it.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

![Los secretos de la mente millonaria (Narración en Castellano) [Secrets of the Millionaire Mind] Audiobook By T. Harv E](https://m.media-amazon.com/images/I/518pmcMK6SL._SL320_.jpg)