-

The Behavior Gap

- Simple Ways to Stop Doing Dumb Things with Money

- Narrated by: Carl Richards

- Length: 3 hrs and 32 mins

Failed to add items

Add to Cart failed.

Add to Wish List failed.

Remove from wishlist failed.

Adding to library failed

Follow podcast failed

Unfollow podcast failed

Buy for $24.06

No default payment method selected.

We are sorry. We are not allowed to sell this product with the selected payment method

Listeners also enjoyed...

-

The One-Page Financial Plan

- A Simple Way to Be Smart About Your Money

- By: Carl Richards

- Narrated by: Carl Richards

- Length: 4 hrs and 3 mins

- Unabridged

-

Overall4.5 out of 5 stars 255

-

Performance4.5 out of 5 stars 222

-

Story4.5 out of 5 stars 221

Whenever I tell people about my job as a financial advisor, the conversation inevitably turns to how hopeless they feel when it comes to dealing with money. More than once they've begged, "Just tell me what to do." It's no surprise that even my most successful friends feel confused or paralyzed. Even if they have a shelfful of personal finance books, they don't have time to make sense of all the information available.

-

4 out of 5 stars

-

A Good and Simple Financial Book

- By Kindle Customer on 02-27-20

By: Carl Richards

-

The Million-Dollar Financial Advisor

- Powerful Lessons and Proven Strategies from Top Producers

- By: David J. Mullen Jr.

- Narrated by: Allan Robertson

- Length: 8 hrs and 24 mins

- Unabridged

-

Overall4.5 out of 5 stars 499

-

Performance4.5 out of 5 stars 418

-

Story4.5 out of 5 stars 413

The best financial advisors are well equipped to succeed regardless of market conditions. Based on interviews with 15 top advisors, each doing several million dollars worth of business every year, The Million-Dollar Financial Advisor distills their universal success principles into 13 distinct lessons. Each is explained step-by-step for immediate application by veteran and new financial professionals alike.

-

5 out of 5 stars

-

Fantastic tips and practices

- By SS MacIntyre on 03-10-15

-

Delivering Massive Value

- The Financial Advisor's Guide to a Highly Profitable, Hyper-Efficient Practice

- By: Matthew Jarvis

- Narrated by: Matthew Jarvis

- Length: 9 hrs and 6 mins

- Unabridged

-

Overall5 out of 5 stars 114

-

Performance5 out of 5 stars 94

-

Story5 out of 5 stars 93

If all the practice consultants and marketing experts have such great ideas to share, why aren't they using them to run their own successful practices? Finally, a book that offers not just ideas but proven strategies for transforming any financial practice into a highly effective value-delivering machine. Practicing financial advisor Matthew Jarvis uses these exact strategies to run his own wildly successful investment firm.

-

5 out of 5 stars

-

A must read/listen

- By Dan Curtis on 01-28-23

By: Matthew Jarvis

-

The Psychology of Money

- Timeless Lessons on Wealth, Greed, and Happiness

- By: Morgan Housel

- Narrated by: Chris Hill

- Length: 5 hrs and 55 mins

- Unabridged

-

Overall5 out of 5 stars 20,272

-

Performance5 out of 5 stars 16,818

-

Story4.5 out of 5 stars 16,727

Money - investing, personal finance, and business decisions - is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together. In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money.

-

3 out of 5 stars

-

Could be summarized in one sentence

- By Alex on 05-30-21

By: Morgan Housel

-

Same as Ever

- A Guide to What Never Changes

- By: Morgan Housel

- Narrated by: Chris Hill

- Length: 5 hrs and 46 mins

- Unabridged

-

Overall4.5 out of 5 stars 708

-

Performance5 out of 5 stars 660

-

Story4.5 out of 5 stars 660

Every investment plan under the sun is, at best, an informed speculation of what may happen in the future, based on a systematic extrapolation from the known past. Same as Ever reverses the process, inviting us to identify the many things that never, ever change. With his usual elan, Morgan Housel presents a master class on optimizing risk, seizing opportunity, and living your best life. Through a sequence of engaging stories and pithy examples, he shows how we can use our newfound grasp of the unchanging to see around corners.

-

3 out of 5 stars

-

Beautifully Succinct Summary of Others Original Ideas

- By Mitch on 11-09-23

By: Morgan Housel

-

The Simple Path to Wealth

- Your Road Map to Financial Independence and a Rich, Free Life

- By: JL Collins

- Narrated by: JL Collins, Peter Adeney

- Length: 6 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 9,112

-

Performance5 out of 5 stars 7,697

-

Story5 out of 5 stars 7,631

This book grew out of a series of letters to my daughter concerning various things - mostly about money and investing - she was not yet quite ready to hear. Since money is the single most powerful tool we have for navigating this complex world we've created, understanding it is critical.

-

1 out of 5 stars

-

Misleading, heavily biased

- By Cody Peralta on 07-19-19

By: JL Collins

-

The One-Page Financial Plan

- A Simple Way to Be Smart About Your Money

- By: Carl Richards

- Narrated by: Carl Richards

- Length: 4 hrs and 3 mins

- Unabridged

-

Overall4.5 out of 5 stars 255

-

Performance4.5 out of 5 stars 222

-

Story4.5 out of 5 stars 221

Whenever I tell people about my job as a financial advisor, the conversation inevitably turns to how hopeless they feel when it comes to dealing with money. More than once they've begged, "Just tell me what to do." It's no surprise that even my most successful friends feel confused or paralyzed. Even if they have a shelfful of personal finance books, they don't have time to make sense of all the information available.

-

4 out of 5 stars

-

A Good and Simple Financial Book

- By Kindle Customer on 02-27-20

By: Carl Richards

-

The Million-Dollar Financial Advisor

- Powerful Lessons and Proven Strategies from Top Producers

- By: David J. Mullen Jr.

- Narrated by: Allan Robertson

- Length: 8 hrs and 24 mins

- Unabridged

-

Overall4.5 out of 5 stars 499

-

Performance4.5 out of 5 stars 418

-

Story4.5 out of 5 stars 413

The best financial advisors are well equipped to succeed regardless of market conditions. Based on interviews with 15 top advisors, each doing several million dollars worth of business every year, The Million-Dollar Financial Advisor distills their universal success principles into 13 distinct lessons. Each is explained step-by-step for immediate application by veteran and new financial professionals alike.

-

5 out of 5 stars

-

Fantastic tips and practices

- By SS MacIntyre on 03-10-15

-

Delivering Massive Value

- The Financial Advisor's Guide to a Highly Profitable, Hyper-Efficient Practice

- By: Matthew Jarvis

- Narrated by: Matthew Jarvis

- Length: 9 hrs and 6 mins

- Unabridged

-

Overall5 out of 5 stars 114

-

Performance5 out of 5 stars 94

-

Story5 out of 5 stars 93

If all the practice consultants and marketing experts have such great ideas to share, why aren't they using them to run their own successful practices? Finally, a book that offers not just ideas but proven strategies for transforming any financial practice into a highly effective value-delivering machine. Practicing financial advisor Matthew Jarvis uses these exact strategies to run his own wildly successful investment firm.

-

5 out of 5 stars

-

A must read/listen

- By Dan Curtis on 01-28-23

By: Matthew Jarvis

-

The Psychology of Money

- Timeless Lessons on Wealth, Greed, and Happiness

- By: Morgan Housel

- Narrated by: Chris Hill

- Length: 5 hrs and 55 mins

- Unabridged

-

Overall5 out of 5 stars 20,272

-

Performance5 out of 5 stars 16,818

-

Story4.5 out of 5 stars 16,727

Money - investing, personal finance, and business decisions - is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together. In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money.

-

3 out of 5 stars

-

Could be summarized in one sentence

- By Alex on 05-30-21

By: Morgan Housel

-

Same as Ever

- A Guide to What Never Changes

- By: Morgan Housel

- Narrated by: Chris Hill

- Length: 5 hrs and 46 mins

- Unabridged

-

Overall4.5 out of 5 stars 708

-

Performance5 out of 5 stars 660

-

Story4.5 out of 5 stars 660

Every investment plan under the sun is, at best, an informed speculation of what may happen in the future, based on a systematic extrapolation from the known past. Same as Ever reverses the process, inviting us to identify the many things that never, ever change. With his usual elan, Morgan Housel presents a master class on optimizing risk, seizing opportunity, and living your best life. Through a sequence of engaging stories and pithy examples, he shows how we can use our newfound grasp of the unchanging to see around corners.

-

3 out of 5 stars

-

Beautifully Succinct Summary of Others Original Ideas

- By Mitch on 11-09-23

By: Morgan Housel

-

The Simple Path to Wealth

- Your Road Map to Financial Independence and a Rich, Free Life

- By: JL Collins

- Narrated by: JL Collins, Peter Adeney

- Length: 6 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 9,112

-

Performance5 out of 5 stars 7,697

-

Story5 out of 5 stars 7,631

This book grew out of a series of letters to my daughter concerning various things - mostly about money and investing - she was not yet quite ready to hear. Since money is the single most powerful tool we have for navigating this complex world we've created, understanding it is critical.

-

1 out of 5 stars

-

Misleading, heavily biased

- By Cody Peralta on 07-19-19

By: JL Collins

-

The Science of Fear

- Why We Fear the Things We Should Not - and Put Ourselves in Great Danger

- By: Daniel Gardner

- Narrated by: Scott Peterson

- Length: 12 hrs and 8 mins

- Unabridged

-

Overall4 out of 5 stars 1,013

-

Performance4 out of 5 stars 671

-

Story4 out of 5 stars 675

From terror attacks to the War on Terror, bursting real-estate bubbles to crystal meth epidemics, sexual predators to poisonous toys from China, our list of fears seems to be exploding. And yet, we are the safest and healthiest humans in history. Irrational fear is running amok, and often with tragic results. In the months after 9/11, when people decided to drive instead of fly - believing they were avoiding risk - road deaths rose by 1,595. Those lives were lost to fear.

-

5 out of 5 stars

-

A rational assessment of the world we live in

- By Kristopher on 08-29-09

By: Daniel Gardner

-

I Will Teach You to Be Rich

- No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)

- By: Ramit Sethi

- Narrated by: Ramit Sethi

- Length: 12 hrs and 8 mins

- Unabridged

-

Overall4.5 out of 5 stars 9,233

-

Performance5 out of 5 stars 7,759

-

Story4.5 out of 5 stars 7,674

Buy as many lattes as you want. Spend extravagantly on the things you love. Live your rich life instead of tracking every last expense with Ramit Sethi’s simple, powerful, and effective six-week program for gaining control over your finances. This isn’t typical advice from a money expert. In this completely updated second edition, Ramit teaches you how to choose long-term investments and the right bank accounts. With his characteristic no-BS perspective, he shows how to squeeze every hidden benefit out of your credit cards.

-

3 out of 5 stars

-

Repetitive - should be retitled.

- By Truth on 06-20-19

By: Ramit Sethi

-

The Millionaire Next Door

- The Surprising Secrets of America's Rich

- By: Thomas J. Stanley Ph.D., William D. Danko Ph.D.

- Narrated by: Cotter Smith

- Length: 8 hrs and 16 mins

- Unabridged

-

Overall4.5 out of 5 stars 19,582

-

Performance4.5 out of 5 stars 15,612

-

Story4.5 out of 5 stars 15,512

Listen to the incredible national best seller that is changing people's lives - and increasing their net worth. Also available:

The Millionaire Mind.

-

3 out of 5 stars

-

A good place to start but watch out!

- By Jeffrey on 05-13-16

By: Thomas J. Stanley Ph.D., and others

-

The Great Depression

- A Diary

- By: James Ledbetter, Daniel B. Roth

- Narrated by: Mike Chamberlain

- Length: 12 hrs and 24 mins

- Unabridged

-

Overall4.5 out of 5 stars 300

-

Performance4.5 out of 5 stars 237

-

Story4.5 out of 5 stars 237

This title offers a first-person diary account of living through the Great Depression, with haunting parallels to our own time. Benjamin Roth was born in New York City in 1894. When the stock market crashed in 1929, he had been practicing law for approximately ten years, largely representing local businesses. After nearly two years, he began to grasp the magnitude of what had happened to American economic life, and he began writing down his impressions in a diary that he maintained intermittently until he died in 1978.

-

5 out of 5 stars

-

Instructive and enjoyable

- By Kenneth on 04-05-13

By: James Ledbetter, and others

-

Building a Non-Anxious Life

- By: Dr. John Delony

- Narrated by: Dr. John Delony

- Length: 6 hrs and 9 mins

- Unabridged

-

Overall4.5 out of 5 stars 256

-

Performance4.5 out of 5 stars 236

-

Story4.5 out of 5 stars 236

Dr. John Delony decided to get to the root of the issue by mapping out a plan to understand where our anxiety is coming from and the actions we can take to change it (because he's been there too). Over the past 20 years, he's learned through research, personal experience, and walking alongside countless others that there are six daily choices people have to make to create a non-anxious life.

-

2 out of 5 stars

-

This Book Made Me More Anxious

- By Titus Gee on 09-30-23

By: Dr. John Delony

-

When Genius Failed

- The Rise and Fall of Long-Term Capital Management

- By: Roger Lowenstein

- Narrated by: Roger Lowenstein

- Length: 9 hrs and 12 mins

- Abridged

-

Overall4.5 out of 5 stars 2,408

-

Performance4.5 out of 5 stars 1,714

-

Story4.5 out of 5 stars 1,707

Roger Lowenstein, the bestselling author of Buffett, captures Long-Term's roller-coaster ride in gripping detail. Drawing on confidential internal memos and interviews with dozens of key players, Lowenstein crafts a story that reads like a first-rate thriller from beginning to end. He explains not just how the fund made and lost its money, but what it was about the personalities of Long-Term's partners, the arrogance of their mathematical certainties, and the late-nineties culture of Wall Street that made it all possible.

-

1 out of 5 stars

-

When Genius Failed

- By Sean on 12-17-08

By: Roger Lowenstein

-

Just Keep Buying

- Proven Ways to Save Money and Build Your Wealth

- By: Nick Maggiulli

- Narrated by: Kevin Meyer

- Length: 6 hrs and 21 mins

- Unabridged

-

Overall4.5 out of 5 stars 465

-

Performance4.5 out of 5 stars 369

-

Story4.5 out of 5 stars 366

Everyone faces big questions when it comes to money. Unfortunately, many of the answers provided by the financial industry have been based on belief and conjecture, rather than data and evidence - until now. The hugely popular finance blogger Nick Maggiulli crunches the numbers to answer your biggest questions, and to provide you with proven ways to build your wealth right away. By following the strategies revealed here, you can act smarter, and live richer, each and every day. It’s time to take the next step in your wealth-building journey!

-

5 out of 5 stars

-

Sound financial advice with balance

- By Donato Santangelo on 11-16-22

By: Nick Maggiulli

-

Pathfinders

- Extraordinary Stories of People Like You on the Quest for Financial Independence—and How to Join Them

- By: JL Collins

- Narrated by: Kevin Meyer, Audrey J Williams

- Length: 9 hrs and 10 mins

- Unabridged

-

Overall4.5 out of 5 stars 101

-

Performance4.5 out of 5 stars 91

-

Story4.5 out of 5 stars 91

From “The Godfather of FI”, a follow-up to his international best-selling personal finance sensation The Simple Path to Wealth! Pathfinders brings together scores of amazing and insightful real-life stories from real people on the journey to financial independence—providing practical encouragement and inspiration for anyone who wants to join them.

-

4 out of 5 stars

-

Wish it was narrated by JL

- By T. Huff on 11-13-23

By: JL Collins

-

Nudge: The Final Edition

- Improving Decisions About Money, Health, and the Environment

- By: Richard H. Thaler, Cass R. Sunstein

- Narrated by: Sean Pratt

- Length: 11 hrs and 33 mins

- Unabridged

-

Overall4.5 out of 5 stars 870

-

Performance4.5 out of 5 stars 722

-

Story4.5 out of 5 stars 713

Since the original publication of Nudge more than a decade ago, the title has entered the vocabulary of businesspeople, policy makers, engaged citizens, and consumers everywhere. The book has given rise to more than 200 "nudge units" in governments around the world and countless groups of behavioral scientists in every part of the economy. It has taught us how to use thoughtful "choice architecture" - a concept the authors invented - to help us make better decisions for ourselves, our families, and our society.

-

2 out of 5 stars

-

Doesn’t include a Pdf of the images the book calls out

- By John O'Connell on 08-03-21

By: Richard H. Thaler, and others

-

Money: Master the Game

- 7 Simple Steps to Financial Freedom

- By: Tony Robbins

- Narrated by: Tony Robbins, Jeremy Bobb

- Length: 21 hrs and 3 mins

- Unabridged

-

Overall4.5 out of 5 stars 14,764

-

Performance4.5 out of 5 stars 12,639

-

Story4.5 out of 5 stars 12,565

Tony Robbins has coached and inspired more than 50 million people from over 100 countries. More than four million people have attended his live events. Oprah Winfrey calls him "super-human". Now for the first time - in his first book in two decades - he's turned to the topic that vexes us all: How to secure financial freedom for ourselves and our families.

-

3 out of 5 stars

-

95% not spoken by Robbins

- By Chong Beng Lim on 11-19-14

By: Tony Robbins

-

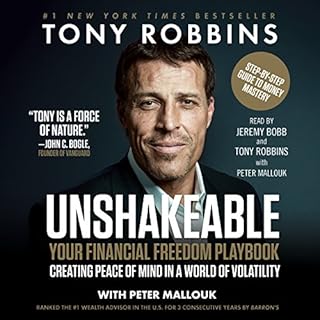

Unshakeable

- Your Financial Freedom Playbook

- By: Tony Robbins

- Narrated by: Tony Robbins, Jeremy Bobb

- Length: 7 hrs and 21 mins

- Unabridged

-

Overall4.5 out of 5 stars 9,420

-

Performance4.5 out of 5 stars 8,014

-

Story4.5 out of 5 stars 7,947

After interviewing 50 of the world's greatest financial minds and penning the number-one New York Times best seller Money: Master the Game, Tony Robbins returns with a step-by-step playbook, taking you on a journey to transform your financial life and accelerate your path to financial freedom. No matter your salary, your stage of life, or when you started, this book will provide the tools to help you achieve your financial goals more rapidly than you ever thought possible.

-

2 out of 5 stars

-

a one sentence summary....

- By Martin on 03-04-17

By: Tony Robbins

-

The Little Book of Common Sense Investing

- The Only Way to Guarantee Your Fair Share of Stock Market Returns, 10th Anniversary Edition

- By: John C. Bogle

- Narrated by: L. J. Ganser

- Length: 5 hrs and 50 mins

- Unabridged

-

Overall4.5 out of 5 stars 2,501

-

Performance4.5 out of 5 stars 2,059

-

Story4.5 out of 5 stars 2,036

The Little Book of Common Sense Investing is the classic guide to getting smart about the market. Legendary mutual fund pioneer John C. Bogle reveals his key to getting more out of investing: low-cost index funds. Bogle describes the simplest and most effective investment strategy for building wealth over the long term: buy and hold, at very low cost, a mutual fund that tracks a broad stock market Index such as the S&P 500.

-

1 out of 5 stars

-

One star for every point this 5 hour book makes.

- By Matt on 01-31-19

By: John C. Bogle

Publisher's summary

"It's not that we're dumb. We're wired to avoid pain and pursue pleasure and security. It feels right to sell when everyone around us is scared, and buy when everyone feels great. It may feel right - but it's not rational." (The Behavior Gap)

Why do we lose money? It's easy to blame the economy or the financial markets - but the real trouble lies in the decisions we make. As a financial planner, Carl Richards grew frustrated watching people he cared about make the same mistakes over and over. They were letting emotion get in the way of smart financial decisions. He named this phenomenon - the distance between what we should do and what we actually do - "the behavior gap". He found that once people understood it, they started doing much better.

Richards's way with words and images has attracted a loyal following to his blog posts for The New York Times, appearances on National Public Radio, and his columns and lectures. His audiobook will teach you how to rethink all kinds of situations where your perfectly natural instincts (for safety or success) can cost you money and peace of mind.

He'll help you to:

- Avoid the tendency to buy high and sell low;

- Avoid the pitfalls of generic financial advice;

- Invest all of your assets - time and energy as well as savings - more wisely;

- Quit spending money and time on things that don't matter;

- Identify your real financial goals;

- Start meaningful conversations about money;

- Simplify your financial life; and

- Stop losing money!

It's never too late to make a fresh financial start. As Richards writes: "We've all made mistakes, but now it's time to give yourself permission to review those mistakes, identify your personal behavior gaps, and make a plan to avoid them in the future. The goal isn't to make the 'perfect' decision about money every time, but to do the best we can and move forward. Most of the time, that's enough."

Critic reviews

More from the same

Author

Narrator

Related to this topic

-

The One-Page Financial Plan

- A Simple Way to Be Smart About Your Money

- By: Carl Richards

- Narrated by: Carl Richards

- Length: 4 hrs and 3 mins

- Unabridged

-

Overall4.5 out of 5 stars 255

-

Performance4.5 out of 5 stars 222

-

Story4.5 out of 5 stars 221

Whenever I tell people about my job as a financial advisor, the conversation inevitably turns to how hopeless they feel when it comes to dealing with money. More than once they've begged, "Just tell me what to do." It's no surprise that even my most successful friends feel confused or paralyzed. Even if they have a shelfful of personal finance books, they don't have time to make sense of all the information available.

-

4 out of 5 stars

-

A Good and Simple Financial Book

- By Kindle Customer on 02-27-20

By: Carl Richards

-

The Education of a Value Investor

- My Transformative Quest for Wealth, Wisdom and Enlightenment

- By: Guy Spier

- Narrated by: Malk Williams

- Length: 6 hrs and 28 mins

- Unabridged

-

Overall4.5 out of 5 stars 1,961

-

Performance4.5 out of 5 stars 1,666

-

Story4.5 out of 5 stars 1,661

What happens when a young Wall Street investment banker spends a small fortune to have lunch with Warren Buffett? He becomes a real value investor. In this fascinating inside story, Guy Spier details his career from Harvard MBA to hedge fund manager. But the path was not so straightforward. Spier reveals his transformation from a Gordon Gekko wannabe, driven by greed, to a sophisticated investor who enjoys success without selling his soul to the highest bidder.

-

5 out of 5 stars

-

Malk Williams does a superb job.

- By Guy Spier on 11-30-14

By: Guy Spier

-

Prince Charming Isn’t Coming

- How Women Get Smart About Money

- By: Barbara Stanny

- Narrated by: Kim Niemi

- Length: 8 hrs and 14 mins

- Unabridged

-

Overall4.5 out of 5 stars 30

-

Performance4.5 out of 5 stars 26

-

Story4.5 out of 5 stars 26

When this groundbreaking yet compassionate audiobook was first published, it lifted a veil on women's resistance to managing their money, revealing that many were still waiting for a prince to rescue them financially. In this revised edition, which reflects our present-day economic world, Barbara Stanny inspires listeners to take charge of their money and their lives. Filled with real-life success stories and practical advice, this audiobook is the next best thing to having one's own financial coach.

-

5 out of 5 stars

-

Should be required reading for all girls.

- By J385 on 04-06-22

By: Barbara Stanny

-

You Can Retire Sooner Than You Think

- By: Wes Moss

- Narrated by: Wes Moss, Scott Merriman

- Length: 7 hrs and 1 min

- Unabridged

-

Overall4.5 out of 5 stars 288

-

Performance4.5 out of 5 stars 240

-

Story4.5 out of 5 stars 236

After conducting an intensive study of happy retirees to learn the financial practices they hold in common, Moss discovered that it doesn't take financial genius, millions of dollars, or sophisticated investment skills to ensure a safe, solid retirement. All it takes is five best practices.

-

4 out of 5 stars

-

graphs/diagrams

- By Amazon Customer on 05-15-18

By: Wes Moss

-

The Rule

- How I Beat the Odds in the Markets and in Life - and How You Can Too

- By: Larry Hite, Michael Covel - foreword

- Narrated by: Scott Pollak

- Length: 5 hrs and 28 mins

- Unabridged

-

Overall4.5 out of 5 stars 55

-

Performance5 out of 5 stars 50

-

Story5 out of 5 stars 49

In The Rule, legendary trader and hedge fund pioneer Larry Hite recounts his working-class upbringing in Brooklyn as a dyslexic, partially blind kid who was anything but a model student - and how he went on to found and run Mint Investment Management Company, one of the most profitable and largest quantitative hedge funds in the world.

-

5 out of 5 stars

-

Asymmetric Leverage! (AL)

- By rrdoc on 01-06-24

By: Larry Hite, and others

-

Tap Dancing to Work

- Warren Buffett on Practically Everything, 1966–2012: A Fortune Magazine Book

- By: Carol J. Loomis

- Narrated by: Susan Boyce, Barry Press

- Length: 17 hrs and 38 mins

- Unabridged

-

Overall4.5 out of 5 stars 283

-

Performance4.5 out of 5 stars 235

-

Story4.5 out of 5 stars 236

When Carol Loomis first mentioned a little-known Omaha hedge-fund manager in a 1966 Fortune article, she didn’t dream that Warren Buffett would one day be considered the world’s greatest investor - nor that she and Buffett would become close personal friends. Now Loomis has collected and updated the best Buffett articles Fortune published between 1966 and 2012, including thirteen cover stories and a dozen pieces authored by Buffett himself. Loomis has provided commentary about each major article that supplies context and her own informed point of view.

-

2 out of 5 stars

-

A collection of finance articles - not a biography

- By Gerardo A Dada on 08-23-13

By: Carol J. Loomis

-

The One-Page Financial Plan

- A Simple Way to Be Smart About Your Money

- By: Carl Richards

- Narrated by: Carl Richards

- Length: 4 hrs and 3 mins

- Unabridged

-

Overall4.5 out of 5 stars 255

-

Performance4.5 out of 5 stars 222

-

Story4.5 out of 5 stars 221

Whenever I tell people about my job as a financial advisor, the conversation inevitably turns to how hopeless they feel when it comes to dealing with money. More than once they've begged, "Just tell me what to do." It's no surprise that even my most successful friends feel confused or paralyzed. Even if they have a shelfful of personal finance books, they don't have time to make sense of all the information available.

-

4 out of 5 stars

-

A Good and Simple Financial Book

- By Kindle Customer on 02-27-20

By: Carl Richards

-

The Education of a Value Investor

- My Transformative Quest for Wealth, Wisdom and Enlightenment

- By: Guy Spier

- Narrated by: Malk Williams

- Length: 6 hrs and 28 mins

- Unabridged

-

Overall4.5 out of 5 stars 1,961

-

Performance4.5 out of 5 stars 1,666

-

Story4.5 out of 5 stars 1,661

What happens when a young Wall Street investment banker spends a small fortune to have lunch with Warren Buffett? He becomes a real value investor. In this fascinating inside story, Guy Spier details his career from Harvard MBA to hedge fund manager. But the path was not so straightforward. Spier reveals his transformation from a Gordon Gekko wannabe, driven by greed, to a sophisticated investor who enjoys success without selling his soul to the highest bidder.

-

5 out of 5 stars

-

Malk Williams does a superb job.

- By Guy Spier on 11-30-14

By: Guy Spier

-

Prince Charming Isn’t Coming

- How Women Get Smart About Money

- By: Barbara Stanny

- Narrated by: Kim Niemi

- Length: 8 hrs and 14 mins

- Unabridged

-

Overall4.5 out of 5 stars 30

-

Performance4.5 out of 5 stars 26

-

Story4.5 out of 5 stars 26

When this groundbreaking yet compassionate audiobook was first published, it lifted a veil on women's resistance to managing their money, revealing that many were still waiting for a prince to rescue them financially. In this revised edition, which reflects our present-day economic world, Barbara Stanny inspires listeners to take charge of their money and their lives. Filled with real-life success stories and practical advice, this audiobook is the next best thing to having one's own financial coach.

-

5 out of 5 stars

-

Should be required reading for all girls.

- By J385 on 04-06-22

By: Barbara Stanny

-

You Can Retire Sooner Than You Think

- By: Wes Moss

- Narrated by: Wes Moss, Scott Merriman

- Length: 7 hrs and 1 min

- Unabridged

-

Overall4.5 out of 5 stars 288

-

Performance4.5 out of 5 stars 240

-

Story4.5 out of 5 stars 236

After conducting an intensive study of happy retirees to learn the financial practices they hold in common, Moss discovered that it doesn't take financial genius, millions of dollars, or sophisticated investment skills to ensure a safe, solid retirement. All it takes is five best practices.

-

4 out of 5 stars

-

graphs/diagrams

- By Amazon Customer on 05-15-18

By: Wes Moss

-

The Rule

- How I Beat the Odds in the Markets and in Life - and How You Can Too

- By: Larry Hite, Michael Covel - foreword

- Narrated by: Scott Pollak

- Length: 5 hrs and 28 mins

- Unabridged

-

Overall4.5 out of 5 stars 55

-

Performance5 out of 5 stars 50

-

Story5 out of 5 stars 49

In The Rule, legendary trader and hedge fund pioneer Larry Hite recounts his working-class upbringing in Brooklyn as a dyslexic, partially blind kid who was anything but a model student - and how he went on to found and run Mint Investment Management Company, one of the most profitable and largest quantitative hedge funds in the world.

-

5 out of 5 stars

-

Asymmetric Leverage! (AL)

- By rrdoc on 01-06-24

By: Larry Hite, and others

-

Tap Dancing to Work

- Warren Buffett on Practically Everything, 1966–2012: A Fortune Magazine Book

- By: Carol J. Loomis

- Narrated by: Susan Boyce, Barry Press

- Length: 17 hrs and 38 mins

- Unabridged

-

Overall4.5 out of 5 stars 283

-

Performance4.5 out of 5 stars 235

-

Story4.5 out of 5 stars 236

When Carol Loomis first mentioned a little-known Omaha hedge-fund manager in a 1966 Fortune article, she didn’t dream that Warren Buffett would one day be considered the world’s greatest investor - nor that she and Buffett would become close personal friends. Now Loomis has collected and updated the best Buffett articles Fortune published between 1966 and 2012, including thirteen cover stories and a dozen pieces authored by Buffett himself. Loomis has provided commentary about each major article that supplies context and her own informed point of view.

-

2 out of 5 stars

-

A collection of finance articles - not a biography

- By Gerardo A Dada on 08-23-13

By: Carol J. Loomis

-

The Little Book of Big Profits from Small Stocks + Website

- Why You'll Never Buy a Stock Over $10 Again (Little Books. Big Profits)

- By: Hilary Kramer

- Narrated by: Walter Dixon

- Length: 3 hrs and 14 mins

- Unabridged

-

Overall4.5 out of 5 stars 58

-

Performance4 out of 5 stars 47

-

Story4 out of 5 stars 43

The key to building wealth the low-priced stock wayLow-priced gems, or what author Hilary Kramer calls "breakout stocks" come in all kinds of shapes and sizes but they all have three things in common: (1) they are mostly under $10; (2) they are undervalued; and (3) they have specific catalysts in the near future that put them on the threshold of breaking out to much higher prices. In The Little Book of Big Profits from Small Stocks, small stock expert Hilary Kramer looks for stocks with fifty to two hundred percent upside potential!

-

4 out of 5 stars

-

Insightful, specific and resourceful!!!

- By Nico on 05-23-12

By: Hilary Kramer

-

Financial Peace Revisited

- New Chapters on Marriage, Singles, Kids and Families

- By: Dave Ramsey

- Narrated by: Nick Sullivan, CJ Critt

- Length: 6 hrs and 59 mins

- Unabridged

-

Overall4.5 out of 5 stars 3,553

-

Performance4.5 out of 5 stars 3,027

-

Story4.5 out of 5 stars 3,004

Dave Ramsey's New York Times best-selling guide to better living through financial security, now completely revised and updated.

-

2 out of 5 stars

-

Surprisingly disappointing - sorry dave

- By Sally on 12-06-12

By: Dave Ramsey

-

Pound Foolish

- Exposing the Dark Side of the Personal Finance Industry

- By: Helaine Olen

- Narrated by: Lyn Landon

- Length: 9 hrs and 1 min

- Unabridged

-

Overall4 out of 5 stars 219

-

Performance4 out of 5 stars 194

-

Story4 out of 5 stars 192

For the past few decades, Americans have spent billions of dollars on personal finance products. As salaries have stagnated and companies have cut back on benefits, we've taken matters into our own hands, embracing the can-do attitude that if we're smart enough, we can overcome even daunting financial obstacles. But that's not true. In this meticulously reported and shocking audiobook, journalist and former financial columnist Helaine Olen goes behind the curtain of the personal finance industry to expose the myths, contradictions, and outright lies it has perpetuated.

-

4 out of 5 stars

-

The dark side of my industry

- By jfoxcpacfp on 06-15-13

By: Helaine Olen

-

Irrationally Yours

- On Missing Socks, Pickup Lines, and Other Existential Puzzles

- By: Dan Ariely

- Narrated by: Simon Jones

- Length: 3 hrs and 22 mins

- Unabridged

-

Overall4 out of 5 stars 226

-

Performance4.5 out of 5 stars 195

-

Story4 out of 5 stars 194

Behavioral economist Dan Ariely revolutionized the way we think about ourselves, our minds, and our actions in his books Predictably Irrational, The Upside of Irrationality, and The Honest Truth About Dishonesty. Ariely applies this scientific analysis of the human condition in his "Ask Ariely" Q and A column in the Wall Street Journal, in which he responds to readers who write in with personal conundrums ranging from the serious to the curious.

-

3 out of 5 stars

-

Not what I expected

- By Gordon on 05-30-15

By: Dan Ariely

-

Charlie Munger

- The Complete Investor

- By: Tren Griffin

- Narrated by: Fred Stella

- Length: 6 hrs and 21 mins

- Unabridged

-

Overall4.5 out of 5 stars 1,683

-

Performance4.5 out of 5 stars 1,379

-

Story4.5 out of 5 stars 1,379

Charlie Munger, Berkshire Hathaway's visionary vice chairman and Warren Buffett's indispensable financial partner, has outperformed market indexes again and again, and he believes any investor can do the same. His notion of "elementary, worldly wisdom" - a set of interdisciplinary mental models involving economics, business, psychology, ethics, and management - allows him to keep his emotions out of his investments and avoid the common pitfalls of bad judgment.

-

4 out of 5 stars

-

Good, but... one major annoyance

- By Joseph R. Compton on 02-26-16

By: Tren Griffin

-

Heads I Win, Tails I Win

- Why Smart Investors Fail and How to Tilt the Odds in Your Favor

- By: Spencer Jakab

- Narrated by: Sean Pratt

- Length: 8 hrs and 30 mins

- Unabridged

-

Overall4.5 out of 5 stars 86

-

Performance4.5 out of 5 stars 74

-

Story4.5 out of 5 stars 75

According to Wall Street Journal investing columnist Spencer Jakab, most of us have no idea how much money we're leaving on the table - or that the average saver doesn't come anywhere close to earning the "average" returns touted in those glossy brochures. We're handicapped not only by psychological biases and a fear of missing out but by an industry with multimillion-dollar marketing budgets and an eye on its own bottom line, not yours.

-

5 out of 5 stars

-

Got my head screwed on straight

- By Rob Barry on 12-20-18

By: Spencer Jakab

-

The Up Side of Down

- Why Failing Well Is the Key to Success

- By: Megan McArdle

- Narrated by: Mia Barron

- Length: 10 hrs and 38 mins

- Unabridged

-

Overall4 out of 5 stars 279

-

Performance4.5 out of 5 stars 233

-

Story4 out of 5 stars 235

Most new products fail. So do most small businesses. And most of us, if we are honest, have experienced a major setback in our personal or professional lives. So what determines who will bounce back and follow up with a home run? If you want to succeed in business and in life, Megan McArdle argues in this hugely thought-provoking book, you have to learn how to harness the power of failure. McArdle has been one of our most popular business bloggers for more than a decade, covering the rise and fall of some the world' s top companies and challenging us to think differently about how we live, learn, and work.

-

4 out of 5 stars

-

Good Book

- By Ray on 05-21-14

By: Megan McArdle

-

How to Make Your First Million

- By: Warren Ingram

- Narrated by: Adrian Galley

- Length: 5 hrs and 3 mins

- Unabridged

-

Overall4.5 out of 5 stars 57

-

Performance4.5 out of 5 stars 47

-

Story4.5 out of 5 stars 46

Your easy-to-understand guide to financial freedom! Have you ever wondered how wealthy people actually made their first million? Here is a book that shows how various people have made their money in their own unique ways, thus allowing you to find a method that works for you so that you, too, can make your first million and gain financial freedom.

-

5 out of 5 stars

-

The best book I never had

- By Amazon Customer on 07-23-17

By: Warren Ingram

-

Broke Millennial Talks Money

- Scripts, Stories, and Advice to Navigate Awkward Financial Conversations

- By: Erin Lowry

- Narrated by: Erin Lowry

- Length: 6 hrs and 58 mins

- Unabridged

-

Overall4.5 out of 5 stars 16

-

Performance4.5 out of 5 stars 14

-

Story4.5 out of 5 stars 12

Let's face it—talking about money is always awkward. In this user-friendly and approachable guide, finance writer Erin Lowry helps take the stress out of these tricky conversations. Lowry arms you with all of the financial knowledge you'll need in order to get the most out of each interaction, whether that's with your friends, your spouse, your employer, or your mom.

By: Erin Lowry

-

Leap

- Leaving a Job with No Plan B to Find the Career and Life You Really Want

- By: Tess Vigeland

- Narrated by: Tess Vigeland

- Length: 7 hrs and 12 mins

- Unabridged

-

Overall4.5 out of 5 stars 136

-

Performance4.5 out of 5 stars 125

-

Story4.5 out of 5 stars 122

Until recently Tess Vigeland was a longtime host of public radio's Marketplace. It was a rewarding, high-status job, and Tess was very good at it - but she'd begun to feel restless. Without any definite, clear sense of what she wanted to do next (but an absolute certainty that what she'd been doing was no longer truly satisfying), she walked away from her dream job and into a vast unknown. Suddenly she was no longer " Marketplace's Tess Vigeland"; she was just Tess Vigeland.

-

3 out of 5 stars

-

Everything Mrs Vigeland says is true, but ...

- By Claude on 10-10-15

By: Tess Vigeland

-

The Index Card

- Why Personal Finance Doesn’t Have to Be Complicated

- By: Helaine Olen, Harold Pollack

- Narrated by: Helaine Olen, Harold Pollack

- Length: 3 hrs and 43 mins

- Unabridged

-

Overall4.5 out of 5 stars 407

-

Performance4.5 out of 5 stars 332

-

Story4.5 out of 5 stars 329

TV analysts and money managers would have you believe your finances are enormously complicated, and if you don't follow their guidance, you'll end up in the poorhouse. They're wrong. When University of Chicago professor Harold Pollack interviewed Helaine Olen, an award-winning financial journalist and the author of the best-selling Pound Foolish, he made an offhand suggestion: Everything you need to know about managing your money could fit on an index card.

-

5 out of 5 stars

-

Getting your personal finance right? Start here.

- By Alan J on 04-27-18

By: Helaine Olen, and others

-

The Truth about Retirement Plans and IRAs

- All the Strategies You Need to Build Savings, Select the Right Investments, and Receive the Retirement Income You Want

- By: Ric Edelman

- Narrated by: Keith Spengel

- Length: 7 hrs and 27 mins

- Unabridged

-

Overall4.5 out of 5 stars 193

-

Performance4.5 out of 5 stars 167

-

Story4.5 out of 5 stars 166

Everyone knows that saving for your retirement is important. Yet only half of all eligible Americans contribute to a retirement plan. That’s because all plans - including the 401(k), 403(b), 457, and even the IRA - are complicated, confusing, and costly. New York Times best-selling author and acclaimed financial advisor Ric Edelman has counseled thousands of savers and retirees and has accumulated his advice in this audiobook.

-

4 out of 5 stars

-

some very great info but be careful

- By Linda Mueller on 11-30-18

By: Ric Edelman

People who viewed this also viewed...

-

The One-Page Financial Plan

- A Simple Way to Be Smart About Your Money

- By: Carl Richards

- Narrated by: Carl Richards

- Length: 4 hrs and 3 mins

- Unabridged

-

Overall4.5 out of 5 stars 255

-

Performance4.5 out of 5 stars 222

-

Story4.5 out of 5 stars 221

Whenever I tell people about my job as a financial advisor, the conversation inevitably turns to how hopeless they feel when it comes to dealing with money. More than once they've begged, "Just tell me what to do." It's no surprise that even my most successful friends feel confused or paralyzed. Even if they have a shelfful of personal finance books, they don't have time to make sense of all the information available.

-

4 out of 5 stars

-

A Good and Simple Financial Book

- By Kindle Customer on 02-27-20

By: Carl Richards

-

Tap Dancing to Work

- Warren Buffett on Practically Everything, 1966–2012: A Fortune Magazine Book

- By: Carol J. Loomis

- Narrated by: Susan Boyce, Barry Press

- Length: 17 hrs and 38 mins

- Unabridged

-

Overall4.5 out of 5 stars 283

-

Performance4.5 out of 5 stars 235

-

Story4.5 out of 5 stars 236

When Carol Loomis first mentioned a little-known Omaha hedge-fund manager in a 1966 Fortune article, she didn’t dream that Warren Buffett would one day be considered the world’s greatest investor - nor that she and Buffett would become close personal friends. Now Loomis has collected and updated the best Buffett articles Fortune published between 1966 and 2012, including thirteen cover stories and a dozen pieces authored by Buffett himself. Loomis has provided commentary about each major article that supplies context and her own informed point of view.

-

2 out of 5 stars

-

A collection of finance articles - not a biography

- By Gerardo A Dada on 08-23-13

By: Carol J. Loomis

-

The Capitalist Code

- It Can Save Your Life and Make You Very Rich

- By: Ben Stein

- Narrated by: Blake Swihart

- Length: 2 hrs and 12 mins

- Unabridged

-

Overall4.5 out of 5 stars 101

-

Performance4 out of 5 stars 88

-

Story4 out of 5 stars 88

Most Americans have not inherited wealth or a successful business that can set them up for life. That means most Americans are destined to live with financial worries and concerns for the rest of their lives, right? Wrong! With his entertaining and informative style, New York Times best-selling author, actor, and financial pundit Ben Stein refutes the current notion that the corporate system is rigged against ordinary citizens and explains how corporate stock ownership is the best system ever devised.

-

4 out of 5 stars

-

underwhelming narration

- By Brandon Crow on 10-27-17

By: Ben Stein

-

Your Money and Your Brain

- How the New Science of Neuroeconomics Can Help Make You Rich

- By: Jason Zweig

- Narrated by: Walter Dixon

- Length: 11 hrs and 39 mins

- Unabridged

-

Overall4.5 out of 5 stars 134

-

Performance4.5 out of 5 stars 109

-

Story4.5 out of 5 stars 109

Zweig, a veteran financial journalist, draws on the latest research in neuroeconomics, a fascinating new discipline that combines psychology, neuroscience, and economics to better understand financial decision making. He shows why we often misunderstand risk and why we tend to be overconfident about our investment decisions. Your Money and Your Brain offers some radical new insights into investing and shows investors how to take control of the battlefield between reason and emotion. Your Money and Your Brain is as entertaining as it is enlightening.

-

5 out of 5 stars

-

Must read for someone who has lost money in stocks

- By Tanmay on 03-09-20

By: Jason Zweig

-

The Psychology of Money

- Timeless Lessons on Wealth, Greed, and Happiness

- By: Morgan Housel

- Narrated by: Chris Hill

- Length: 5 hrs and 55 mins

- Unabridged

-

Overall5 out of 5 stars 20,272

-

Performance5 out of 5 stars 16,818

-

Story4.5 out of 5 stars 16,727

Money - investing, personal finance, and business decisions - is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together. In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money.

-

3 out of 5 stars

-

Could be summarized in one sentence

- By Alex on 05-30-21

By: Morgan Housel

-

You Can Retire Sooner Than You Think

- By: Wes Moss

- Narrated by: Wes Moss, Scott Merriman

- Length: 7 hrs and 1 min

- Unabridged

-

Overall4.5 out of 5 stars 288

-

Performance4.5 out of 5 stars 240

-

Story4.5 out of 5 stars 236

After conducting an intensive study of happy retirees to learn the financial practices they hold in common, Moss discovered that it doesn't take financial genius, millions of dollars, or sophisticated investment skills to ensure a safe, solid retirement. All it takes is five best practices.

-

4 out of 5 stars

-

graphs/diagrams

- By Amazon Customer on 05-15-18

By: Wes Moss

-

The One-Page Financial Plan

- A Simple Way to Be Smart About Your Money

- By: Carl Richards

- Narrated by: Carl Richards

- Length: 4 hrs and 3 mins

- Unabridged

-

Overall4.5 out of 5 stars 255

-

Performance4.5 out of 5 stars 222

-

Story4.5 out of 5 stars 221

Whenever I tell people about my job as a financial advisor, the conversation inevitably turns to how hopeless they feel when it comes to dealing with money. More than once they've begged, "Just tell me what to do." It's no surprise that even my most successful friends feel confused or paralyzed. Even if they have a shelfful of personal finance books, they don't have time to make sense of all the information available.

-

4 out of 5 stars

-

A Good and Simple Financial Book

- By Kindle Customer on 02-27-20

By: Carl Richards

-

Tap Dancing to Work

- Warren Buffett on Practically Everything, 1966–2012: A Fortune Magazine Book

- By: Carol J. Loomis

- Narrated by: Susan Boyce, Barry Press

- Length: 17 hrs and 38 mins

- Unabridged

-

Overall4.5 out of 5 stars 283

-

Performance4.5 out of 5 stars 235

-

Story4.5 out of 5 stars 236

When Carol Loomis first mentioned a little-known Omaha hedge-fund manager in a 1966 Fortune article, she didn’t dream that Warren Buffett would one day be considered the world’s greatest investor - nor that she and Buffett would become close personal friends. Now Loomis has collected and updated the best Buffett articles Fortune published between 1966 and 2012, including thirteen cover stories and a dozen pieces authored by Buffett himself. Loomis has provided commentary about each major article that supplies context and her own informed point of view.

-

2 out of 5 stars

-

A collection of finance articles - not a biography

- By Gerardo A Dada on 08-23-13

By: Carol J. Loomis

-

The Capitalist Code

- It Can Save Your Life and Make You Very Rich

- By: Ben Stein

- Narrated by: Blake Swihart

- Length: 2 hrs and 12 mins

- Unabridged

-

Overall4.5 out of 5 stars 101

-

Performance4 out of 5 stars 88

-

Story4 out of 5 stars 88

Most Americans have not inherited wealth or a successful business that can set them up for life. That means most Americans are destined to live with financial worries and concerns for the rest of their lives, right? Wrong! With his entertaining and informative style, New York Times best-selling author, actor, and financial pundit Ben Stein refutes the current notion that the corporate system is rigged against ordinary citizens and explains how corporate stock ownership is the best system ever devised.

-

4 out of 5 stars

-

underwhelming narration

- By Brandon Crow on 10-27-17

By: Ben Stein

-

Your Money and Your Brain

- How the New Science of Neuroeconomics Can Help Make You Rich

- By: Jason Zweig

- Narrated by: Walter Dixon

- Length: 11 hrs and 39 mins

- Unabridged

-

Overall4.5 out of 5 stars 134

-

Performance4.5 out of 5 stars 109

-

Story4.5 out of 5 stars 109

Zweig, a veteran financial journalist, draws on the latest research in neuroeconomics, a fascinating new discipline that combines psychology, neuroscience, and economics to better understand financial decision making. He shows why we often misunderstand risk and why we tend to be overconfident about our investment decisions. Your Money and Your Brain offers some radical new insights into investing and shows investors how to take control of the battlefield between reason and emotion. Your Money and Your Brain is as entertaining as it is enlightening.

-

5 out of 5 stars

-

Must read for someone who has lost money in stocks

- By Tanmay on 03-09-20

By: Jason Zweig

-

The Psychology of Money

- Timeless Lessons on Wealth, Greed, and Happiness

- By: Morgan Housel

- Narrated by: Chris Hill

- Length: 5 hrs and 55 mins

- Unabridged

-

Overall5 out of 5 stars 20,272

-

Performance5 out of 5 stars 16,818

-

Story4.5 out of 5 stars 16,727

Money - investing, personal finance, and business decisions - is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together. In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money.

-

3 out of 5 stars

-

Could be summarized in one sentence

- By Alex on 05-30-21

By: Morgan Housel

-

You Can Retire Sooner Than You Think

- By: Wes Moss

- Narrated by: Wes Moss, Scott Merriman

- Length: 7 hrs and 1 min

- Unabridged

-

Overall4.5 out of 5 stars 288

-

Performance4.5 out of 5 stars 240

-

Story4.5 out of 5 stars 236

After conducting an intensive study of happy retirees to learn the financial practices they hold in common, Moss discovered that it doesn't take financial genius, millions of dollars, or sophisticated investment skills to ensure a safe, solid retirement. All it takes is five best practices.

-

4 out of 5 stars

-

graphs/diagrams

- By Amazon Customer on 05-15-18

By: Wes Moss

-

Clever Girl Finance

- Ditch Debt, Save Money and Build Real Wealth

- By: Bola Sokunbi

- Narrated by: Bola Sokunbi

- Length: 4 hrs and 59 mins

- Unabridged

-

Overall4.5 out of 5 stars 221

-

Performance4.5 out of 5 stars 180

-

Story4.5 out of 5 stars 179

Join the ranks of thousands of smart and savvy women who have turned to money expert and author Bola Sokunbi for guidance on ditching debt, saving money, and building real wealth. Sokunbi, the force behind the hugely popular Clever Girl Finance website, draws on her personal money mistakes and financial redemption to educate and empower a new generation of women on their journey to financial freedom. Lighthearted and accessible, Clever Girl Finance encourages women to talk about money and financial wellness.

-

5 out of 5 stars

-

Good book for financial guidance especially at a young age

- By Emmah on 10-02-19

By: Bola Sokunbi

-

Richer, Wiser, Happier

- How the World's Greatest Investors Win in Markets and Life

- By: William Green

- Narrated by: Raphael Corkhill

- Length: 11 hrs and 33 mins

- Unabridged

-

Overall5 out of 5 stars 1,567

-

Performance4.5 out of 5 stars 1,326

-

Story5 out of 5 stars 1,322

Billionaire investors. If we think of them, it’s with a mixture of awe and suspicion. Clearly, they possess a kind of genius - the proverbial Midas Touch. But are the skills they possess transferable? And do they have anything to teach us besides making money? In Richer, Wiser, Happier, William Green draws on interviews that he’s conducted over 25 years with many of the world’s greatest investors. As he discovered, their talents extend well beyond the financial realm.

-

5 out of 5 stars

-

Excellent Work of Art

- By T. Eller on 04-25-21

By: William Green

-

The Science of Fear

- Why We Fear the Things We Should Not - and Put Ourselves in Great Danger

- By: Daniel Gardner

- Narrated by: Scott Peterson

- Length: 12 hrs and 8 mins

- Unabridged

-

Overall4 out of 5 stars 1,013

-

Performance4 out of 5 stars 671

-

Story4 out of 5 stars 675

From terror attacks to the War on Terror, bursting real-estate bubbles to crystal meth epidemics, sexual predators to poisonous toys from China, our list of fears seems to be exploding. And yet, we are the safest and healthiest humans in history. Irrational fear is running amok, and often with tragic results. In the months after 9/11, when people decided to drive instead of fly - believing they were avoiding risk - road deaths rose by 1,595. Those lives were lost to fear.

-

5 out of 5 stars

-

A rational assessment of the world we live in

- By Kristopher on 08-29-09

By: Daniel Gardner

-

The Most Important Thing

- Uncommon Sense for The Thoughtful Investor

- By: Howard Marks

- Narrated by: John FitzGibbon

- Length: 7 hrs and 9 mins

- Unabridged

-

Overall4.5 out of 5 stars 2,271

-

Performance4.5 out of 5 stars 1,845

-

Story4.5 out of 5 stars 1,824

Howard Marks, the chairman and cofounder of Oaktree Capital Management, is renowned for his insightful assessments of market opportunity and risk. After four decades spent ascending to the top of the investment management profession, he is today sought out by the world's leading value investors, and his client memos brim with insightful commentary and a time-tested, fundamental philosophy. The Most Important Thing explains the keys to successful investment and the pitfalls that can destroy capital or ruin a career.

-

5 out of 5 stars

-

Five Star Book, two Star Audiobook

- By Johnny on 06-08-15

By: Howard Marks

-

Misbehaving

- The Making of Behavioral Economics

- By: Richard H. Thaler

- Narrated by: L. J. Ganser

- Length: 13 hrs and 35 mins

- Unabridged

-

Overall4.5 out of 5 stars 6,415

-

Performance4.5 out of 5 stars 5,506

-

Story4.5 out of 5 stars 5,463

Richard H. Thaler has spent his career studying the radical notion that the central agents in the economy are humans - predictable, error-prone individuals. Misbehaving is his arresting, frequently hilarious account of the struggle to bring an academic discipline back down to earth - and change the way we think about economics, ourselves, and our world.

-

3 out of 5 stars

-

Great book if it's your first about Behav. Econ

- By Jay Friedman on 09-30-15

-

Die with Zero

- Getting All You Can from Your Money and Your Life

- By: Bill Perkins

- Narrated by: Bill Perkins

- Length: 5 hrs and 11 mins

- Unabridged

-

Overall4.5 out of 5 stars 795

-

Performance4.5 out of 5 stars 689

-

Story4.5 out of 5 stars 684

Die with Zero presents a startling new and provocative philosophy as well as practical guide on how to get the most out of your money—and out of your life. It's intended for those who place lifelong memorable experiences far ahead of simply making and accumulating money for one's so-called Golden Years. In short, Bill Perkins wants to rescue you from over-saving and under-living. Regardless of your age, Die with Zero will teach you Perkins' plan for optimizing your life, stage by stage, so you're fully engaged and enjoying what you've worked and saved for.

-

2 out of 5 stars

-

Nothing extraordinary

- By Anonymous User on 06-27-23

By: Bill Perkins

-

Personal Finance for Dummies, 9th Edition

- By: Eric Tyson MBA

- Narrated by: Steven Jay Cohen

- Length: 20 hrs and 34 mins

- Unabridged

-

Overall4.5 out of 5 stars 83

-

Performance4 out of 5 stars 64

-

Story4.5 out of 5 stars 61

Take stock of your financial situation From budgeting, saving, and reducing debt, to making timely investment choices and planning for the future, Personal Finance for Dummies, 9th Edition provides fiscally conscious listeners with the tools they need to take charge of their financial life. This new edition includes coverage of an extensive new tax bill that took effect in 2018. Plus, it covers emerging investing interests like technology and global investing, cryptocurrencies, pot stocks, the lifestyle changes occurring with millennials, and more.

-

1 out of 5 stars

-

Cannot get past the narration

- By Cory Warnick on 07-28-19

By: Eric Tyson MBA

-

The Next Millionaire Next Door

- Enduring Strategies for Building Wealth

- By: Sarah Stanley Fallaw, Thomas J. Stanley

- Narrated by: Stephen Wojtas

- Length: 7 hrs and 11 mins

- Unabridged

-

Overall4.5 out of 5 stars 683

-

Performance4.5 out of 5 stars 553

-

Story4.5 out of 5 stars 549

Over the past 40 years, Tom Stanley and his daughter Sarah Stanley Fallaw have been involved in research examining how self-made, economically successful Americans became that way. Despite the publication of The Millionaire Next Door, The Millionaire Mind, and others, myths about wealth in America still abound. Government officials, journalists, and many American still tend to confuse income with wealth.

-

3 out of 5 stars

-

Not Much New

- By Amazon Customer on 01-26-20

By: Sarah Stanley Fallaw, and others

-

Same as Ever

- A Guide to What Never Changes

- By: Morgan Housel

- Narrated by: Chris Hill

- Length: 5 hrs and 46 mins

- Unabridged

-

Overall4.5 out of 5 stars 708

-

Performance5 out of 5 stars 660

-

Story4.5 out of 5 stars 660

Every investment plan under the sun is, at best, an informed speculation of what may happen in the future, based on a systematic extrapolation from the known past. Same as Ever reverses the process, inviting us to identify the many things that never, ever change. With his usual elan, Morgan Housel presents a master class on optimizing risk, seizing opportunity, and living your best life. Through a sequence of engaging stories and pithy examples, he shows how we can use our newfound grasp of the unchanging to see around corners.

-

3 out of 5 stars

-

Beautifully Succinct Summary of Others Original Ideas

- By Mitch on 11-09-23

By: Morgan Housel

-

The Millionaire Next Door

- The Surprising Secrets of America's Rich

- By: Thomas J. Stanley Ph.D., William D. Danko Ph.D.

- Narrated by: Cotter Smith

- Length: 8 hrs and 16 mins

- Unabridged

-

Overall4.5 out of 5 stars 19,582

-

Performance4.5 out of 5 stars 15,612

-

Story4.5 out of 5 stars 15,512

Listen to the incredible national best seller that is changing people's lives - and increasing their net worth. Also available:

The Millionaire Mind.

-

3 out of 5 stars

-

A good place to start but watch out!

- By Jeffrey on 05-13-16

By: Thomas J. Stanley Ph.D., and others

-

A Random Walk Down Wall Street, 12th Edition

- The Time Tested Strategy for Successful Investing

- By: Burton G. Malkiel

- Narrated by: George Guidall

- Length: 11 hrs and 42 mins

- Unabridged

-

Overall4.5 out of 5 stars 1,328

-

Performance4.5 out of 5 stars 1,083

-

Story4.5 out of 5 stars 1,066

At a time of frightening volatility, what is the average investor to do? The answer: Turn to Burton G. Malkiel's advice in his reassuring, authoritative, gimmick-free, and perennially best-selling guide to investing. Long established as the first book to purchase before starting a portfolio or 401(k), A Random Walk Down Wall Street now features new material on "tax-loss harvesting", the crown jewel of tax management; the current bitcoin bubble; and automated investment advisers; as well as a brand-new chapter on factor investing and risk parity.

-

3 out of 5 stars

-

Why no pdf of charts???

- By P. Kastenholz on 06-27-19

-

Predictably Irrational

- The Hidden Forces That Shape Our Decisions

- By: Dan Ariely

- Narrated by: Simon Jones

- Length: 7 hrs and 22 mins

- Unabridged

-

Overall4.5 out of 5 stars 12,507

-

Performance4.5 out of 5 stars 8,800

-

Story4.5 out of 5 stars 8,771

In a series of illuminating, often surprising experiments, MIT behavioral economist Dan Ariely refutes the common assumption that we behave in fundamentally rational ways. Blending everyday experience with groundbreaking research, Ariely explains how expectations, emotions, social norms, and other invisible, seemingly illogical forces skew our reasoning abilities.

-

3 out of 5 stars

-

Good lessons, mediocre science?

- By William Stanger on 02-24-09

By: Dan Ariely

What listeners say about The Behavior Gap

Average customer ratingsReviews - Please select the tabs below to change the source of reviews.

-

Overall3 out of 5 stars

-

Performance3 out of 5 stars

-

Story3 out of 5 stars

- michael

- 01-23-18

Average across the board

Not a bad book, but nothing special about it either. Nothing ground breaking or interesting. Basically just 3 hrs of him telling you to not be lead by your emotions, have a plan, and buy low sell high.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

1 person found this helpful

-

Overall5 out of 5 stars

-

Performance4 out of 5 stars

-

Story4 out of 5 stars

- lowery

- 09-10-19

great read!

Quick yet informative. For investors, you should keep these rules in the front of your mind at all times for financial success. Loved it.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- CHRISTINA KERSTE

- 05-12-20

Fantastic Book

This book has a ton of good information about investing in the long run, and why we sometimes make decisions that go against our goals. Overall it’s a great book

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- The Shop-aholic

- 07-22-17

Phenomenal. Simple. Practical!

I am a financial advisor with hundreds of counts. I really enjoyed this book! Will listen again and again!

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Steve Phair

- 09-11-19

great book

easy read, well listen. author kept on topic and followed a structure for ease of understanding. didnt belabor the point just made it and moved on.

some great real world examples given. I have since updated some models in my business plan.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Jeffrey

- 01-19-21

As a ChFC, RICP, Financial Advisor with around 400 clients.

This book is as close to the guidance you could get from an advisor without actually meeting with an advisor. To the authors credit he shares the value of the profession and why people should have someone to talk through these topics with. I honestly might purchase this book for my top 40-50 clients as a birthday gift this year to reinforce such good lessons in our planning.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Dana Menard

- 07-07-18

The Only Investing Book You Ever Need

Carl Richards is the rare genius who can explain all of the complex investing and financial concepts in an easy-to-explain manner. A must read for all investors!

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- T. Kalinowski

- 05-12-21

Short into the point my behavior

Definitely worth the read since we all make previous things based on behavior. We all do dumb things based on our behavior with money.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall4 out of 5 stars

-

Performance5 out of 5 stars

-

Story4 out of 5 stars

- MK

- 05-31-15

Another simple yet true reminder from this author!

What did you love best about The Behavior Gap?

Just the reminder it gave to keep common sense in perspective when it comes to finances. Sure, I know this, I have been told this, but doing it needs frequent nudges.

What other book might you compare The Behavior Gap to and why?

His other book, the one page financial plan, which I read first and appreciated the simple style of for wrapping our minds around these ideas - focusing on the simple, important actions rather than the minute complicated peripheral traps of financial savvy.

What about Carl Richards’s performance did you like?

He was relatable.

Did you have an extreme reaction to this book? Did it make you laugh or cry?

Just how simple and true of a reminder it was to just make big strides in the right general direction and not get all psyched out about details.

Any additional comments?

Great little reminder primer for financial common sense.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Hannah Lincoln

- 01-15-17

Excellent. Sound advice, charismatic narrator/author.

Cannot recommend this more. Especially good as someone in her 20s gearing up for more serious financially responsible behavior.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!