-

Money Management to Become Wealthy

- Narrated by: William Bahl

- Length: 1 hr and 27 mins

Failed to add items

Add to Cart failed.

Add to Wish List failed.

Remove from wishlist failed.

Adding to library failed

Follow podcast failed

Unfollow podcast failed

Prime members: New to Audible?

Prime members: New to Audible?Get 2 free audiobooks during trial.

Buy for $6.95

No default payment method selected.

We are sorry. We are not allowed to sell this product with the selected payment method

Listeners also enjoyed...

-

Passive Income: Proven Business Ideas for Anyone to Generate Passive Income Streams (Crack the Code to Make Money Online)

- By: Phil Clarke, Robert Covey

- Narrated by: William Bahl

- Length: 3 hrs and 23 mins

- Unabridged

-

Overall5 out of 5 stars 61

-

Performance5 out of 5 stars 60

-

Story5 out of 5 stars 60

These strategies and easy tips transform you from the dreaded 9-5 job to living life the way it's suppose to be lived. You'll be able to travel more and work from home all while your money is making money. You'll learn all these things and so much more. Most people today have no idea how much money there is to be made through Online channels, but after listening to this audiobook, you will. No matter how fast or how slow you want to go, you'll be able to tap into a wealth of information.

-

5 out of 5 stars

-

Life can be different for you, and faster than you

- By Murray on 04-27-20

By: Phil Clarke, and others

-

The Essential Small Business Guide to Financial Management

- Streamlined Strategies for Maximized Profits, Compliance, and Long-Term Success for Money-Stressed Entrepreneurs

- By: DBR Publishing

- Narrated by: Jamal West

- Length: 3 hrs and 17 mins

- Unabridged

-

Overall5 out of 5 stars 52

-

Performance5 out of 5 stars 52

-

Story5 out of 5 stars 52

Is your business struggling? Equip yourself with proven financial strategies for growth and success. Fear not the daunting statistics: 20% of new businesses fold within two years, 45% within five, and a staggering 65% within a decade. However, 25% thrive beyond 15 years. What sets them apart? The answer often lies in mastering financial management, the hidden driver of long-term success. This book is your guide to joining that triumphant 25%, arming you with practical financial skills to propel your entrepreneurial journey from surviving to thriving.

-

5 out of 5 stars

-

Already Less Stressed About my Business!

- By Zujkywa on 02-25-24

By: DBR Publishing

-

One Year’s Roadmap to a Seven-Figure Business

- Earn Financial Freedom, Say Goodbye to a Career, Create Generational Wealth, Master Money Management, Personal Investments, Passive Income and Budgeting

- By: Paris Pinchem, Lourena De Abreu

- Narrated by: Kelly Rhodes

- Length: 2 hrs and 56 mins

- Unabridged

-

Overall0 out of 5 stars 0

-

Performance0 out of 5 stars 0

-

Story0 out of 5 stars 0

It may not be your desire to be confined to a nine-to-five job. The idea of engaging in a business that will rake in a seven-figure income by the end of the year will help you gain your independence. This is the road map to your financial freedom. It is a perfect guide for helping you explore yourself business-wise and achieve very big goals in a short space of time.

By: Paris Pinchem, and others

-

Money Mindset Secrets: 9 Step to Financial Freedom

- Spartan University Series, Book 1

- By: José Martínez

- Narrated by: William Bahl

- Length: 1 hr and 2 mins

- Unabridged

-

Overall5 out of 5 stars 83

-

Performance5 out of 5 stars 82

-

Story5 out of 5 stars 82

Can money bring you success, happiness, love and freedom? Whatever your goal you will need a strategy. Money Mindset Secrets: 9 Steps to Financial Freedom has been recorded to guide you on your journey. This book will guide you through the nine steps to make money and the best ideas to earn income in simple and easily digestible chunks.

-

5 out of 5 stars

-

Like this book so far, so many great gems in it

- By Olivia Rose on 10-23-19

By: José Martínez

-

Cryptocurrency Mining: The Ultimate Guide About Blockchain, Mining, Trading, ICO, Ethereum Platform, Exchanges

- By: Robert Sinek

- Narrated by: William Bahl

- Length: 3 hrs and 18 mins

- Unabridged

-

Overall5 out of 5 stars 54

-

Performance5 out of 5 stars 53

-

Story5 out of 5 stars 53

This audiobook is here to walk you through all the information that you need to understand the process of mining cryptocurrencies. You will learn a lot of the basics for starting your mining rig to help you get the most from your mining adventures. The second part offers you a comprehensive investment section. This is not another guide that pushes trading strategies from stocks into Cryptocurrencies. We are investors ourselves, and we have seen everything cryptosphere has to offer.

-

5 out of 5 stars

-

Thanks Robert Sinek.

- By Steven on 10-25-20

By: Robert Sinek

-

Money. Wealth. Life Insurance.

- How the Wealthy Use Life Insurance as a Tax-Free Personal Bank to Supercharge Their Savings

- By: Jake Thompson

- Narrated by: Alan Caudle

- Length: 1 hr and 27 mins

- Unabridged

-

Overall4.5 out of 5 stars 1,299

-

Performance4.5 out of 5 stars 1,067

-

Story4.5 out of 5 stars 1,058

America's elite have been using cash value life insurance to stockpile wealth for centuries. Used correctly, it is better described as a personal bank on steroids, and a financial bunker for tough times. To be clear, this audiobook is not about the typical garbage peddled by most insurance agents. Rather, an alternative to the risky investment strategies taught by Wall Street. It details a highly efficient form of cash value life insurance designed to supercharge your savings and stockpile wealth.

-

1 out of 5 stars

-

what the heck was this?

- By Gladys Torres on 10-20-16

By: Jake Thompson

-

Passive Income: Proven Business Ideas for Anyone to Generate Passive Income Streams (Crack the Code to Make Money Online)

- By: Phil Clarke, Robert Covey

- Narrated by: William Bahl

- Length: 3 hrs and 23 mins

- Unabridged

-

Overall5 out of 5 stars 61

-

Performance5 out of 5 stars 60

-

Story5 out of 5 stars 60

These strategies and easy tips transform you from the dreaded 9-5 job to living life the way it's suppose to be lived. You'll be able to travel more and work from home all while your money is making money. You'll learn all these things and so much more. Most people today have no idea how much money there is to be made through Online channels, but after listening to this audiobook, you will. No matter how fast or how slow you want to go, you'll be able to tap into a wealth of information.

-

5 out of 5 stars

-

Life can be different for you, and faster than you

- By Murray on 04-27-20

By: Phil Clarke, and others

-

The Essential Small Business Guide to Financial Management

- Streamlined Strategies for Maximized Profits, Compliance, and Long-Term Success for Money-Stressed Entrepreneurs

- By: DBR Publishing

- Narrated by: Jamal West

- Length: 3 hrs and 17 mins

- Unabridged

-

Overall5 out of 5 stars 52

-

Performance5 out of 5 stars 52

-

Story5 out of 5 stars 52

Is your business struggling? Equip yourself with proven financial strategies for growth and success. Fear not the daunting statistics: 20% of new businesses fold within two years, 45% within five, and a staggering 65% within a decade. However, 25% thrive beyond 15 years. What sets them apart? The answer often lies in mastering financial management, the hidden driver of long-term success. This book is your guide to joining that triumphant 25%, arming you with practical financial skills to propel your entrepreneurial journey from surviving to thriving.

-

5 out of 5 stars

-

Already Less Stressed About my Business!

- By Zujkywa on 02-25-24

By: DBR Publishing

-

One Year’s Roadmap to a Seven-Figure Business

- Earn Financial Freedom, Say Goodbye to a Career, Create Generational Wealth, Master Money Management, Personal Investments, Passive Income and Budgeting

- By: Paris Pinchem, Lourena De Abreu

- Narrated by: Kelly Rhodes

- Length: 2 hrs and 56 mins

- Unabridged

-

Overall0 out of 5 stars 0

-

Performance0 out of 5 stars 0

-

Story0 out of 5 stars 0

It may not be your desire to be confined to a nine-to-five job. The idea of engaging in a business that will rake in a seven-figure income by the end of the year will help you gain your independence. This is the road map to your financial freedom. It is a perfect guide for helping you explore yourself business-wise and achieve very big goals in a short space of time.

By: Paris Pinchem, and others

-

Money Mindset Secrets: 9 Step to Financial Freedom

- Spartan University Series, Book 1

- By: José Martínez

- Narrated by: William Bahl

- Length: 1 hr and 2 mins

- Unabridged

-

Overall5 out of 5 stars 83

-

Performance5 out of 5 stars 82

-

Story5 out of 5 stars 82

Can money bring you success, happiness, love and freedom? Whatever your goal you will need a strategy. Money Mindset Secrets: 9 Steps to Financial Freedom has been recorded to guide you on your journey. This book will guide you through the nine steps to make money and the best ideas to earn income in simple and easily digestible chunks.

-

5 out of 5 stars

-

Like this book so far, so many great gems in it

- By Olivia Rose on 10-23-19

By: José Martínez

-

Cryptocurrency Mining: The Ultimate Guide About Blockchain, Mining, Trading, ICO, Ethereum Platform, Exchanges

- By: Robert Sinek

- Narrated by: William Bahl

- Length: 3 hrs and 18 mins

- Unabridged

-

Overall5 out of 5 stars 54

-

Performance5 out of 5 stars 53

-

Story5 out of 5 stars 53

This audiobook is here to walk you through all the information that you need to understand the process of mining cryptocurrencies. You will learn a lot of the basics for starting your mining rig to help you get the most from your mining adventures. The second part offers you a comprehensive investment section. This is not another guide that pushes trading strategies from stocks into Cryptocurrencies. We are investors ourselves, and we have seen everything cryptosphere has to offer.

-

5 out of 5 stars

-

Thanks Robert Sinek.

- By Steven on 10-25-20

By: Robert Sinek

-

Money. Wealth. Life Insurance.

- How the Wealthy Use Life Insurance as a Tax-Free Personal Bank to Supercharge Their Savings

- By: Jake Thompson

- Narrated by: Alan Caudle

- Length: 1 hr and 27 mins

- Unabridged

-

Overall4.5 out of 5 stars 1,299

-

Performance4.5 out of 5 stars 1,067

-

Story4.5 out of 5 stars 1,058

America's elite have been using cash value life insurance to stockpile wealth for centuries. Used correctly, it is better described as a personal bank on steroids, and a financial bunker for tough times. To be clear, this audiobook is not about the typical garbage peddled by most insurance agents. Rather, an alternative to the risky investment strategies taught by Wall Street. It details a highly efficient form of cash value life insurance designed to supercharge your savings and stockpile wealth.

-

1 out of 5 stars

-

what the heck was this?

- By Gladys Torres on 10-20-16

By: Jake Thompson

-

Smart Retirement Planning

- Winning Strategies to Build Large Sums of Retirement Income; Investing, Creating Passive Income and Making Your Money Last a Lifetime

- By: Noelle Romero

- Narrated by: Samantha Novak

- Length: 5 hrs and 31 mins

- Unabridged

-

Overall5 out of 5 stars 48

-

Performance5 out of 5 stars 48

-

Story5 out of 5 stars 48

We spend most of our adult lives working to be able to enjoy our retirement but forgetting that life was meant to be enjoyed in the here and now. But what if I told you that you didn’t have to live that way? What if I said you could work smarter rather than harder, retire early if you want to, travel the world, and make all of your dreams for the future a reality?

-

5 out of 5 stars

-

I wish this book was available years ago!

- By Reinaldo Gonzalez on 02-10-24

By: Noelle Romero

-

99 Financial Terms Every Beginner, Entrepreneur & Business Should Know

- The Simple Guide to Financial Literacy, Financial Intelligence & Independence, Financial Freedom & Peace.

- By: Thomas Herold

- Narrated by: William Bahl

- Length: 7 hrs and 9 mins

- Unabridged

-

Overall4.5 out of 5 stars 68

-

Performance4.5 out of 5 stars 62

-

Story4.5 out of 5 stars 62

Whenever you hear someone speak personal finance, do you feel like you’re learning a foreign language? Do you feel lost when reading or hearing financial terminology from your bank, insurance, investment agent, or the IRS? You’re not alone! If you cannot comprehend basic financial concepts, such as interest compounding and financial risk diversification, you're paying higher transaction fees, you pile up unmanageable debts, and you also end up paying higher interest on loans.

-

5 out of 5 stars

-

Well-being and freedom starts

- By Perry on 06-11-19

By: Thomas Herold

-

Rich Dad Poor Dad

- What the Rich Teach Their Kids About Money - That the Poor and Middle Class Do Not!

- By: Robert T. Kiyosaki

- Narrated by: Tim Wheeler

- Length: 6 hrs and 9 mins

- Unabridged

-

Overall5 out of 5 stars 77,852

-

Performance4.5 out of 5 stars 64,452

-

Story5 out of 5 stars 64,182

With an incredible number of 5-star reviews, Rich Dad Poor Dad has challenged and changed the way tens of millions of people around the world think about money. With perspectives that often contradict conventional wisdom, Kiyosaki has earned a reputation for irreverence and courage. He is regarded worldwide as a passionate advocate for financial education. His easy-to-understand audiobook empowers you to make changes now - and enjoy the results for years to come.

-

5 out of 5 stars

-

great book but....

- By Mathew Copeland on 11-28-17

-

The Simple Path to Wealth

- Your Road Map to Financial Independence and a Rich, Free Life

- By: JL Collins

- Narrated by: JL Collins, Peter Adeney

- Length: 6 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 9,105

-

Performance5 out of 5 stars 7,692

-

Story5 out of 5 stars 7,626

This book grew out of a series of letters to my daughter concerning various things - mostly about money and investing - she was not yet quite ready to hear. Since money is the single most powerful tool we have for navigating this complex world we've created, understanding it is critical.

-

1 out of 5 stars

-

Misleading, heavily biased

- By Cody Peralta on 07-19-19

By: JL Collins

-

Business Entrepreneurship Beyond the 9 to 5

- For Those Starting Out or Starting Over

- By: Taylor Daniels

- Narrated by: Jeremiah Cahours

- Length: 2 hrs and 56 mins

- Unabridged

-

Overall5 out of 5 stars 23

-

Performance5 out of 5 stars 23

-

Story5 out of 5 stars 23

Discover just how impactful and incredible being a business entrepreneur can be for you and your family. Are you worried about the added stress that living paycheck to paycheck causes you and your family? Sixty-three percent of Americans are living paycheck to paycheck. Keep reading to make sure you’re not one of them. While you may feel that you will never have the time or energy to start a business, there are ways to work around this so that money problems become a thing of your past.

-

5 out of 5 stars

-

Audiobook is a great resource!

- By Tlee on 02-07-23

By: Taylor Daniels

-

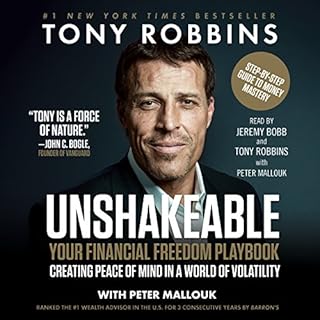

Unshakeable

- Your Financial Freedom Playbook

- By: Tony Robbins

- Narrated by: Tony Robbins, Jeremy Bobb

- Length: 7 hrs and 21 mins

- Unabridged

-

Overall4.5 out of 5 stars 9,417

-

Performance4.5 out of 5 stars 8,013

-

Story4.5 out of 5 stars 7,946

After interviewing 50 of the world's greatest financial minds and penning the number-one New York Times best seller Money: Master the Game, Tony Robbins returns with a step-by-step playbook, taking you on a journey to transform your financial life and accelerate your path to financial freedom. No matter your salary, your stage of life, or when you started, this book will provide the tools to help you achieve your financial goals more rapidly than you ever thought possible.

-

2 out of 5 stars

-

a one sentence summary....

- By Martin on 03-04-17

By: Tony Robbins

-

Short-Term Rental, Long-Term Wealth

- Your Guide to Analyzing, Buying, and Managing Vacation Properties

- By: Avery Carl

- Narrated by: Leanne Woodward

- Length: 4 hrs and 31 mins

- Unabridged

-

Overall5 out of 5 stars 977

-

Performance5 out of 5 stars 851

-

Story5 out of 5 stars 843

Airbnb, Vrbo, and other listing services have become massively popular in recent years - why not tap into the gold mine? Whether you’re new to real estate investing or you want to add a new strategy to your growing portfolio, vacation rentals can be an extremely lucrative way to add an extra income stream - but only if you acquire and manage your properties correctly.

-

2 out of 5 stars

-

It’s read by a robot

- By Ian Wymond on 09-16-22

By: Avery Carl

-

The Personal MBA: Master the Art of Business

- By: Josh Kaufman

- Narrated by: Josh Kaufman

- Length: 15 hrs and 25 mins

- Unabridged

-

Overall4.5 out of 5 stars 7,142

-

Performance4.5 out of 5 stars 6,051

-

Story4.5 out of 5 stars 6,009

Josh Kaufman founded PersonalMBA.com as an alternative to the business school boondoggle. His blog has introduced hundreds of thousands of readers to the best business books and most powerful business concepts of all time. Now, he shares the essentials of entrepreneurship, marketing, sales, negotiation, operations, productivity, systems design, and much more, in one comprehensive volume. The Personal MBA distills the most valuable business lessons into simple, memorable mental models that can be applied to real-world challenges.

-

5 out of 5 stars

-

Not an MBA, But A Damn Decent Experience.

- By Cori on 01-20-13

By: Josh Kaufman

-

Crushing It in Apartments and Commercial Real Estate

- How a Small Investor Can Make It Big

- By: Brian H Murray

- Narrated by: Chris Abell

- Length: 7 hrs and 27 mins

- Unabridged

-

Overall5 out of 5 stars 2,226

-

Performance5 out of 5 stars 1,902

-

Story4.5 out of 5 stars 1,891

Brian Murray was not an investment pro when he bought his first commercial property. He was a teacher looking to build some side income. Armed with his passion for business and a lot of common sense, he developed a simple yet highly effective approach to investing that he still uses today at his multimillion-dollar real estate company.

-

5 out of 5 stars

-

A must have investment book

- By Brandon Sturgill on 05-24-17

By: Brian H Murray

-

Set for Life, Revised Edition

- An All-Out Approach to Early Financial Freedom

- By: Scott Trench

- Narrated by: Scott Trench

- Length: 9 hrs and 22 mins

- Unabridged

-

Overall4.5 out of 5 stars 4,972

-

Performance4.5 out of 5 stars 4,269

-

Story4.5 out of 5 stars 4,232

Scott Trench—real estate investor, co-host of the BiggerPockets Money Podcast, and CEO of BiggerPockets—demonstrates how to accumulate a lifetime of wealth over a short period of time. Even starting with zero savings, you can go from a five-figure income to six figures, from an active job to passive income, then finally to the ultimate goal of financial independence.

-

4 out of 5 stars

-

Set for American life

- By Anonymous User on 05-11-17

By: Scott Trench

-

Quit Like a Millionaire

- No Gimmicks, Luck, or Trust Fund Required

- By: Kristy Shen, Bryce Leung, JL Collins

- Narrated by: Kristy Shen, JL Collins

- Length: 8 hrs and 40 mins

- Unabridged

-

Overall4.5 out of 5 stars 1,346

-

Performance4.5 out of 5 stars 1,168

-

Story4.5 out of 5 stars 1,163

Kristy Shen retired with a million dollars at the age of 31, and she did it without hitting a home run on the stock market, starting the next Snapchat in her garage, or investing in hot real estate. Learn how to cut down on spending without decreasing your quality of life, build a million-dollar portfolio, fortify your investments to survive bear markets and black-swan events, and use the four percent rule and the Yield Shield - so you can quit the rat race forever.

-

1 out of 5 stars

-

She gives some bad advice.

- By Brian Bingham on 02-13-20

By: Kristy Shen, and others

-

Great CEOs Are Lazy

- By: Jim Schleckser

- Narrated by: Jim Schleckser

- Length: 5 hrs and 18 mins

- Unabridged

-

Overall4.5 out of 5 stars 230

-

Performance4.5 out of 5 stars 190

-

Story4.5 out of 5 stars 189

How do the really exceptional CEOs get more done in less time than everyone else? What is their technique for getting their work done, while still having the time to spend pursuing hobbies and spending quality time with their friends and family? The truth is that great and lazy CEOs know a secret when it comes to time management. Rather than spending a little time on a lot of things, the best CEOs spend most of their time eliminating the single biggest constraint to the growth of their business.

-

5 out of 5 stars

-

Loved It!

- By Mike E. on 07-10-19

By: Jim Schleckser

Publisher's summary

Money management is as important as any business. It is the way those continuous drops of water can become an ocean. Of course, it is like cracking nuts to raise money to start any business up. Nevertheless, the main gig is the proper management of the funds to become wealthy. This demands quite several skills, wisdom, and expertise. As time goes and the company gets more substantial, there might be a need for more professionalism which either you or an expert must take the shoe. Do not worry; this audiobook got you covered on the necessary basics you need.

It is impossible to follow this audiobook carefully and not become wealthy through management. The statistics, information, and other related contents provided in this audiobook are from reliable sources. This audiobook discussed money, how to raise enough of it for business startups, its liquidity in the current business world, management, and how to do it properly. Finally, having gathered enough details from different wealthy businessmen, the audiobook provides necessary information about “The keys to wealth that never change”. Just listen and follow carefully.

More from the same

Author

Related to this topic

-

Angel Investing

- The Gust Guide to Making Money and Having Fun Investing in Startups

- By: David S. Rose

- Narrated by: David S. Rose

- Length: 6 hrs and 42 mins

- Unabridged

-

Overall4.5 out of 5 stars 176

-

Performance4.5 out of 5 stars 146

-

Story4.5 out of 5 stars 143

From building your reputation as a smart investor, to negotiating fair deals, adding value to your portfolio companies and helping them implement smart exit strategies, David provides both the fundamental strategies and the specific tools you need to take full advantage of this rapidly growing asset class.

-

5 out of 5 stars

-

Very enlightening

- By Keith L. on 04-06-15

By: David S. Rose

-

The Founder's Dilemmas

- By: Noam Wasserman

- Narrated by: Mark Mosely

- Length: 13 hrs and 28 mins

- Unabridged

-

Overall4.5 out of 5 stars 721

-

Performance4.5 out of 5 stars 579

-

Story4 out of 5 stars 571

Often downplayed in the excitement of starting up a new business venture is one of the most important decisions entrepreneurs will face: should they go it alone, or bring in cofounders, hires, and investors to help build the business? More than just financial rewards are at stake. Friendships and relationships can suffer. Bad decisions at the inception of a promising venture lay the foundations for its eventual ruin.

-

2 out of 5 stars

-

Too much talk on the data

- By Stanley Tan on 10-02-14

By: Noam Wasserman

-

Shark Tank Jump Start Your Business

- How to Launch and Grow a Business from Concept to Cash

- By: Michael Parrish DuDell, Mark Cuban, Barbara Corcoran, and others

- Narrated by: Michael Parrish DuDell

- Length: 6 hrs and 5 mins

- Unabridged

-

Overall4 out of 5 stars 1,485

-

Performance4 out of 5 stars 1,271

-

Story4 out of 5 stars 1,268

From the ABC hit show Shark Tank, this book - filled with practical advice and introductions from the Sharks themselves - will be the ultimate resource for anyone thinking about starting a business or growing the one they have. Full of tips for navigating the confusing world of entrepreneurship, the book will intersperse words of wisdom with inspirational stories from the show.

-

2 out of 5 stars

-

Middle School material. Vague, no depth.

- By nate on 12-22-13

By: Michael Parrish DuDell, and others

-

The Millionaire Maker

- Act, Think, and Make Money the Way the Wealthy Do

- By: Loral Langemeier

- Narrated by: Bernadette Dunn

- Length: 4 hrs and 43 mins

- Unabridged

-

Overall5 out of 5 stars 38

-

Performance5 out of 5 stars 30

-

Story5 out of 5 stars 30

There are only two things millionaires have that you don't: wealth and the knowledge to build wealth. But that's all about to change. Thanks to “Millionaire Maker” Loral Langemeier, you can develop the same financial intelligence that millionaires use to create, grow, and sustain their fortunes.

-

4 out of 5 stars

-

Loral is a Genius

- By Amber on 04-14-24

By: Loral Langemeier

-

Finish Big

- How Great Entrepreneurs Exit Their Companies on Top

- By: Bo Burlingham

- Narrated by: Sean Pratt

- Length: 10 hrs and 17 mins

- Unabridged

-

Overall4.5 out of 5 stars 158

-

Performance4.5 out of 5 stars 130

-

Story4.5 out of 5 stars 128

When pioneering business journalist and Inc. magazine editor at large Bo Burlingham wrote Small Giants, it became an instant classic for its original take on a common business problem - how to handle the pressure to grow. Now Burlingham is back to tackle an even more common problem - how to exit your company well. Sooner or later, all entrepreneurs leave their businesses and all businesses get sold, given away, or liquidated.

-

5 out of 5 stars

-

Begin with the end in mind

- By D. Hartzell on 02-05-15

By: Bo Burlingham

-

12 Months to $1 Million

- How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure Entrepreneur

- By: Ryan Daniel Moran

- Narrated by: Ryan Daniel Moran

- Length: 7 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 3,537

-

Performance5 out of 5 stars 3,047

-

Story5 out of 5 stars 3,031

By cutting out the noise and providing a clear and proven plan, this road map helps even brand-new entrepreneurs make decisions quickly, get their product up for sale, and launch it to a crowd that is ready and waiting to buy. This one-year plan will guide you through the three stages to your first $1 million: the Grind (months 0-4), the Growth (months 5-8), and the Gold (months 9-12). If your goal is to be a full-time entrepreneur, get ready for one chaotic, stressful, and rewarding year. If you have the guts to complete it, you will be the proud owner of a million-dollar business.

-

4 out of 5 stars

-

Good, but a Little Misleading

- By Chris Love on 11-28-20

-

Angel Investing

- The Gust Guide to Making Money and Having Fun Investing in Startups

- By: David S. Rose

- Narrated by: David S. Rose

- Length: 6 hrs and 42 mins

- Unabridged

-

Overall4.5 out of 5 stars 176

-

Performance4.5 out of 5 stars 146

-

Story4.5 out of 5 stars 143

From building your reputation as a smart investor, to negotiating fair deals, adding value to your portfolio companies and helping them implement smart exit strategies, David provides both the fundamental strategies and the specific tools you need to take full advantage of this rapidly growing asset class.

-

5 out of 5 stars

-

Very enlightening

- By Keith L. on 04-06-15

By: David S. Rose

-

The Founder's Dilemmas

- By: Noam Wasserman

- Narrated by: Mark Mosely

- Length: 13 hrs and 28 mins

- Unabridged

-

Overall4.5 out of 5 stars 721

-

Performance4.5 out of 5 stars 579

-

Story4 out of 5 stars 571

Often downplayed in the excitement of starting up a new business venture is one of the most important decisions entrepreneurs will face: should they go it alone, or bring in cofounders, hires, and investors to help build the business? More than just financial rewards are at stake. Friendships and relationships can suffer. Bad decisions at the inception of a promising venture lay the foundations for its eventual ruin.

-

2 out of 5 stars

-

Too much talk on the data

- By Stanley Tan on 10-02-14

By: Noam Wasserman

-

Shark Tank Jump Start Your Business

- How to Launch and Grow a Business from Concept to Cash

- By: Michael Parrish DuDell, Mark Cuban, Barbara Corcoran, and others

- Narrated by: Michael Parrish DuDell

- Length: 6 hrs and 5 mins

- Unabridged

-

Overall4 out of 5 stars 1,485

-

Performance4 out of 5 stars 1,271

-

Story4 out of 5 stars 1,268

From the ABC hit show Shark Tank, this book - filled with practical advice and introductions from the Sharks themselves - will be the ultimate resource for anyone thinking about starting a business or growing the one they have. Full of tips for navigating the confusing world of entrepreneurship, the book will intersperse words of wisdom with inspirational stories from the show.

-

2 out of 5 stars

-

Middle School material. Vague, no depth.

- By nate on 12-22-13

By: Michael Parrish DuDell, and others

-

The Millionaire Maker

- Act, Think, and Make Money the Way the Wealthy Do

- By: Loral Langemeier

- Narrated by: Bernadette Dunn

- Length: 4 hrs and 43 mins

- Unabridged

-

Overall5 out of 5 stars 38

-

Performance5 out of 5 stars 30

-

Story5 out of 5 stars 30

There are only two things millionaires have that you don't: wealth and the knowledge to build wealth. But that's all about to change. Thanks to “Millionaire Maker” Loral Langemeier, you can develop the same financial intelligence that millionaires use to create, grow, and sustain their fortunes.

-

4 out of 5 stars

-

Loral is a Genius

- By Amber on 04-14-24

By: Loral Langemeier

-

Finish Big

- How Great Entrepreneurs Exit Their Companies on Top

- By: Bo Burlingham

- Narrated by: Sean Pratt

- Length: 10 hrs and 17 mins

- Unabridged

-

Overall4.5 out of 5 stars 158

-

Performance4.5 out of 5 stars 130

-

Story4.5 out of 5 stars 128

When pioneering business journalist and Inc. magazine editor at large Bo Burlingham wrote Small Giants, it became an instant classic for its original take on a common business problem - how to handle the pressure to grow. Now Burlingham is back to tackle an even more common problem - how to exit your company well. Sooner or later, all entrepreneurs leave their businesses and all businesses get sold, given away, or liquidated.

-

5 out of 5 stars

-

Begin with the end in mind

- By D. Hartzell on 02-05-15

By: Bo Burlingham

-

12 Months to $1 Million

- How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure Entrepreneur

- By: Ryan Daniel Moran

- Narrated by: Ryan Daniel Moran

- Length: 7 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 3,537

-

Performance5 out of 5 stars 3,047

-

Story5 out of 5 stars 3,031

By cutting out the noise and providing a clear and proven plan, this road map helps even brand-new entrepreneurs make decisions quickly, get their product up for sale, and launch it to a crowd that is ready and waiting to buy. This one-year plan will guide you through the three stages to your first $1 million: the Grind (months 0-4), the Growth (months 5-8), and the Gold (months 9-12). If your goal is to be a full-time entrepreneur, get ready for one chaotic, stressful, and rewarding year. If you have the guts to complete it, you will be the proud owner of a million-dollar business.

-

4 out of 5 stars

-

Good, but a Little Misleading

- By Chris Love on 11-28-20

-

The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime

- By: MJ DeMarco

- Narrated by: MJ DeMarco

- Length: 12 hrs and 46 mins

- Unabridged

-

Overall4.5 out of 5 stars 8,177

-

Performance4.5 out of 5 stars 7,040

-

Story4.5 out of 5 stars 7,008

Since you were old enough to hold a job, you've been hoodwinked to believe that wealth can be created by blindly trusting in the uncontrollable and unpredictable markets: the housing market, the stock market, and the job market. I call this soul-sucking, dream-stealing dogma "The Slowlane" - an impotent financial gamble that dubiously promises wealth in a wheelchair. For those who don't want a lifetime subscription to "settle-for-less", there is an alternative.

-

5 out of 5 stars

-

Excellent!

- By Iray007 on 09-22-15

By: MJ DeMarco

-

I Will Teach You to Be Rich

- No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)

- By: Ramit Sethi

- Narrated by: Ramit Sethi

- Length: 12 hrs and 8 mins

- Unabridged

-

Overall4.5 out of 5 stars 9,218

-

Performance5 out of 5 stars 7,744

-

Story4.5 out of 5 stars 7,659

Buy as many lattes as you want. Spend extravagantly on the things you love. Live your rich life instead of tracking every last expense with Ramit Sethi’s simple, powerful, and effective six-week program for gaining control over your finances. This isn’t typical advice from a money expert. In this completely updated second edition, Ramit teaches you how to choose long-term investments and the right bank accounts. With his characteristic no-BS perspective, he shows how to squeeze every hidden benefit out of your credit cards.

-

3 out of 5 stars

-

Repetitive - should be retitled.

- By Truth on 06-20-19

By: Ramit Sethi

-

The Simple Path to Wealth

- Your Road Map to Financial Independence and a Rich, Free Life

- By: JL Collins

- Narrated by: JL Collins, Peter Adeney

- Length: 6 hrs and 38 mins

- Unabridged

-

Overall5 out of 5 stars 9,105

-

Performance5 out of 5 stars 7,692

-

Story5 out of 5 stars 7,626

This book grew out of a series of letters to my daughter concerning various things - mostly about money and investing - she was not yet quite ready to hear. Since money is the single most powerful tool we have for navigating this complex world we've created, understanding it is critical.

-

1 out of 5 stars

-

Misleading, heavily biased

- By Cody Peralta on 07-19-19

By: JL Collins

-

Plan Your Year Like a Millionaire

- By: Rachel Rodgers

- Narrated by: Rachel Rodgers

- Length: 2 hrs

- Original Recording

-

Overall4.5 out of 5 stars 1,142

-

Performance4.5 out of 5 stars 1,110

-

Story4 out of 5 stars 1,109

Plan Like a Millionaire is part of a riveting three-part series, and it's all about elevating your game and setting goals like a seven-figure earner. In this wealth-inspiring listening journey, Rachel reveals the secrets of how to set goals, manage time wisely, build essential support systems, break free from financial constraints, and make savvy money decisions.

-

3 out of 5 stars

-

Feel Good Book, only

- By Maggie on 01-06-24

By: Rachel Rodgers

-

The Creature from Jekyll Island

- A Second Look at the Federal Reserve

- By: G. Edward Griffin

- Narrated by: Mark Bramhall

- Length: 24 hrs and 21 mins

- Unabridged

-

Overall4.5 out of 5 stars 5,690

-

Performance5 out of 5 stars 5,015

-

Story4.5 out of 5 stars 5,012

This classic expose of the Fed has become one of the best-selling books in its category of all time. Where does money come from? Where does it go? Who makes it? The money magician's secrets are unveiled. Here is a close look at their mirrors and smoke machines, the pulleys, cogs, and wheels that create the grand illusion called money. A boring subject? Just wait. You'll be hooked in five minutes. It reads like a detective story - which it really is, but it's all true.

-

1 out of 5 stars

-

Lost confidence in author

- By Amazon Customer on 07-11-20

-

Million-Dollar Habits

- By: Rachel Rodgers

- Narrated by: Rachel Rodgers

- Length: 2 hrs and 3 mins

- Original Recording

-

Overall4 out of 5 stars 218

-

Performance4.5 out of 5 stars 211

-

Story4 out of 5 stars 211

Rachel Rodgers, personal finance expert and author of the best-selling We Should All Be Millionaires, delivers yet again in her three-part Audible Originals series. In Million Dollar Habits, Rodgers puts forward the habits you would do well to adopt in order to generate wealth. And before she gets to those habits, she first encourages you to raise your financial goals.

-

5 out of 5 stars

-

Ready to light a fire under your butt?

- By J. Bailey on 04-08-24

By: Rachel Rodgers

-

Six-Figure Side Hustle

- By: Rachel Rodgers

- Narrated by: Rachel Rodgers

- Length: 3 hrs and 42 mins

- Original Recording

-

Overall4 out of 5 stars 383

-

Performance4 out of 5 stars 367

-

Story4 out of 5 stars 367

Rachel Rodgers, financial maven and heralded author of We Should All Be Millionaires, has created a groundbreaking new Audible Original series with Six Figure Side Hustle. In this installment of a dynamic three-part audio journey, Rachel unveils the blueprint for turning spare time into a $100,000-per-year side hustle in just three months.

-

4 out of 5 stars

-

Not For YOU!

- By S. Seigel on 03-02-24

By: Rachel Rodgers

-

How to Day Trade for a Living

- A Beginner's Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology

- By: Andrew Aziz

- Narrated by: Kevin Foley

- Length: 6 hrs and 56 mins

- Unabridged

-

Overall4.5 out of 5 stars 1,301

-

Performance4.5 out of 5 stars 1,049

-

Story4.5 out of 5 stars 1,045

Very few careers can offer you the freedom, flexibility, and income that day trading does. As a day trader, you can live and work anywhere in the world. You can decide when to work and when not to work. You only answer to yourself. That is the life of the successful day trader. Many people aspire to it, but very few succeed. In the audiobook, I describe the fundamentals of day trading, explain how day trading is different from other styles of trading and investment, and elaborate on important trading strategies that many traders use every day.

-

3 out of 5 stars

-

Its a sales pitch

- By Xavier Foley on 02-08-18

By: Andrew Aziz

-

Invisible Women

- Data Bias in a World Designed for Men

- By: Caroline Criado Perez

- Narrated by: Caroline Criado Perez

- Length: 9 hrs and 25 mins

- Unabridged

-

Overall4.5 out of 5 stars 3,068

-

Performance4.5 out of 5 stars 2,678

-

Story4.5 out of 5 stars 2,650

Data is fundamental to the modern world. From economic development, to healthcare, to education and public policy, we rely on numbers to allocate resources and make crucial decisions. But because so much data fails to take into account gender, treating men as the default and women as atypical, bias and discrimination are baked into our systems. And women pay tremendous costs for this bias in time, money, and often with their lives. Celebrated feminist advocate Caroline Criado Perez investigates the shocking root cause of gender inequality and research in Invisible Women.

-

2 out of 5 stars

-

A statistical fire hose

- By B. Andresen on 09-11-19

-

The Little Book of Common Sense Investing

- The Only Way to Guarantee Your Fair Share of Stock Market Returns, 10th Anniversary Edition

- By: John C. Bogle

- Narrated by: L. J. Ganser

- Length: 5 hrs and 50 mins

- Unabridged

-

Overall4.5 out of 5 stars 2,498

-

Performance4.5 out of 5 stars 2,058

-

Story4.5 out of 5 stars 2,035

The Little Book of Common Sense Investing is the classic guide to getting smart about the market. Legendary mutual fund pioneer John C. Bogle reveals his key to getting more out of investing: low-cost index funds. Bogle describes the simplest and most effective investment strategy for building wealth over the long term: buy and hold, at very low cost, a mutual fund that tracks a broad stock market Index such as the S&P 500.

-

1 out of 5 stars

-

One star for every point this 5 hour book makes.

- By Matt on 01-31-19

By: John C. Bogle

-

The 1-Page Marketing Plan

- Get New Customers, Make More Money, And Stand Out From The Crowd

- By: Allan Dib

- Narrated by: Joel Richards

- Length: 6 hrs and 32 mins

- Unabridged

-

Overall5 out of 5 stars 5,051

-

Performance5 out of 5 stars 4,351

-

Story5 out of 5 stars 4,296

To build a successful business, you need to stop doing random acts of marketing and start following a reliable plan for rapid business growth. Traditionally, creating a marketing plan has been a difficult and time-consuming process, which is why it often doesn't get done.

-

1 out of 5 stars

-

You Need to buy Book to get key info

- By Rosie's mom on 10-23-18

By: Allan Dib

-

Emotional Investment

- By: Fresh Produce Media

- Narrated by: Amanda Clayman

- Length: 5 hrs and 36 mins

- Original Recording

-

Overall5 out of 5 stars 16

-

Performance5 out of 5 stars 15

-

Story4.5 out of 5 stars 15

In Emotional Investment, therapist-turned-financial coach Amanda Clayman works with a range of people and couples to unravel money dilemmas. Along the way, Clayman gives us practical tools—both financial and emotional—that we can all use in our own lives.

-

5 out of 5 stars

-

So honest and engaging to hear people’s money stories.

- By Jc on 04-12-24

What listeners say about Money Management to Become Wealthy

Average customer ratingsReviews - Please select the tabs below to change the source of reviews.

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Marshall Shepard

- 03-25-20

Buy this! Seriously!

This book gives you the information you need to help you get your finances in order without being soo boring it looses your attention like a lot of books in it's field! I recommend this book to everyone that needs a little help adulting.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Barbara

- 07-04-21

Effective Leadership Development is a Process

The goal is to become wealthy. This means you cannot have only one source of income. You must be able to diversify your business ideas and be involved in many of them. Not all businesses will pay well at the same time. Despite having a principal investment, you can implore other business ideas to what you are doing. For example, if you are a fabric industry, you can include dry cleaning as a side hustle. This will provide money that you can spend at the moment while you divert all the money from the central business back into the main business.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Megan Platt

- 07-05-21

The content of this book helped me get ahead in ..

Senior managers such as Chief Executive Officer (CEO), members of a Board of Directors and or a President of an organization. They are in charge of setting the strategic goals of the firm. They also help to make decisions on how the worldwide organization will run and operate its course. A senior manager is generally a professional at the executive level. He provides direction to middle management, who will either directly or indirectly report to him.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Ethel

- 06-26-21

Trade by barter lacks transferability.

This makes the system confusing, tiring, and yet, ineffective. As if that is not enough, the problem persists. If after Mr. A has found Mr. B who has apples and would not mind meat in exchange, Mr. A may not see 50 apples as the equivalent to a goat. This makes the whole entire transaction more complicated and both parties must find a solution to it. They can both come into an agreement, which would possibly exchange some parts of the goat for 50 apples. If this is not handled correctly, it will lead to even more harm than good in the long run.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Patricia

- 07-06-21

ABC’s. How to master your money

Money management is a big fish, but some men are masters at it. Knowledge is power. Hence, you can get resources that will widen your scope on things to do, approaches to take, and steps to follow.

Pay attention to the resource. Identify which technique is suitable with your business and the ones out of your league. You can combine knowledge with experience and become a pro when it comes to money management.

A proper manager of money cannot help but make you rich. This is just as basic as ABC’s.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Colleen Powers

- 03-23-20

Words of wisdom

Even though I prefer a hands-off well diversified portfolio and invest with dollar cost averaging, I think that this instructor presents a good argument for business startups and how to raise enough, its liquidity in the current business world, management, and how to do it properly. I personally do not wish to devote all of my free time to doing that, nor do I want to pay fees for mutual funds, so this is why I go with an index fund approach. This provides necessary information about “The keys to wealth that never change”

Since I'm totally new to stock exchange investment, this course has helped me to gain momentum. Bahl's explanation on the basic terminologies has helped me to easily grace through stock related articles on the internet as well as news media. Aside from the fact that Matt's investment strategy may differ from mine slightly, I enjoyed very much lecture 6 and the emphasis on rational thinking along with Buffett ways of thinking.

I also enjoyed the tie in with headlines and reminded us about herd mentality. Thanks William Bahl!

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

10 people found this helpful

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Sidney

- 03-23-20

Godsend!

Good, basic way to get you on a budget. Will have to follow the program for a few days before I can fully comment. The instructor is very good. Clear, no nonsense approach to budgets.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- Janet

- 06-29-21

One word SIMPLE!

Amazing course! I've never found such an informed guide to what a consultant does and how to do it. The instructor includes incredibly valuable job application tips as well.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- James

- 06-24-21

STUDY this book.

For a venture with a dream of a bigger fish, you have no reason to panic. You can still raise sufficient money for more ambitious projects via venture capital funding. All you need is access to angel investors. Angel investors are also known as business angel, angel funder, private investor, informal investor, or seed investor. The angel investor is an affluent individual who supplies capital for a startup. This is often done in exchange for ownership equity or debt that can be converted. Just as the name implies, angel investors, they are there to provide support to start-ups even onset and at the risk of the business failing and obviously becoming high. Also, you can run to an angel investor any day, anytime even when other investors are not ready to provide support for you. We now have an increasing number of angel investors available on the Internet. They are very small but invest online through equity crowd funding. With this equity crowd funding, they are able to organize themselves into angel networks or groups to share investment capital and also provide advice to their portfolio companies. There are many more angel investors out there than they used to be. Venture capital firms also provide professionalism, which is lacking in venture. Such professionalism could be a strategy, legal, or simply marketing knowledge. This is a common occurrence for corporate venture capital because the startup benefits from the corporation. How? The venture can use the corporation’s brand name to gain more ground and improve its influence.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

19 people found this helpful

-

Overall5 out of 5 stars

-

Performance5 out of 5 stars

-

Story5 out of 5 stars

- George Rothe

- 06-30-21

My Money Management Manual.

In factoring, you sell your accounts to a buyer as a commercial finance company. This is to help raise your capital. The factor will buy the receivable account at a discounted rate between 1 and 15 percent. This makes them factor the creditor who collects the receivables as paper chores. Well, factoring allows you to sell your customer’s accounts without notifying them. Factoring has its cons and pros of course. Business experts do not suggest factoring as a quick option in bootstrapping finances. In short, they advise that factoring should be your last resort if you still cannot acquire necessary capital from other sources. Apart from the fact that factoring reduces internal cost, it also frees money that could have been put down as receivables. If your business is one that sells to other companies or the government, factoring will offset long-delayed payment. This would generate more profit for you through other means. With factoring, you can raise money and ensure it has a constant flow.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

15 people found this helpful