Financial Tip: His financial book teaches principles like self-control, patience, and hope

No se pudo agregar al carrito

Solo puedes tener X títulos en el carrito para realizar el pago.

Add to Cart failed.

Por favor prueba de nuevo más tarde

Error al Agregar a Lista de Deseos.

Por favor prueba de nuevo más tarde

Error al eliminar de la lista de deseos.

Por favor prueba de nuevo más tarde

Error al añadir a tu biblioteca

Por favor intenta de nuevo

Error al seguir el podcast

Intenta nuevamente

Error al dejar de seguir el podcast

Intenta nuevamente

-

Narrado por:

-

De:

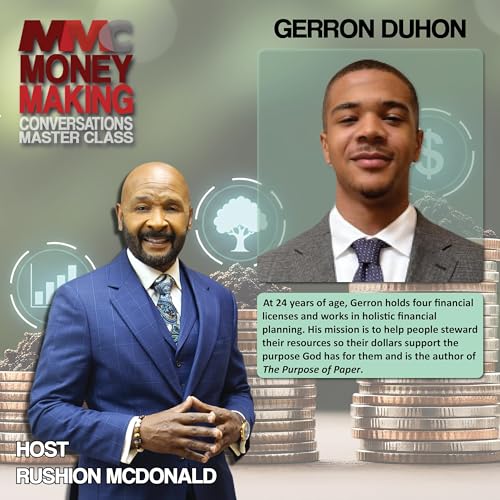

Two-time Emmy and Three-time NAACP Image Award-winning, television Executive Producer Rushion McDonald interviewed Gerron Duhon.

Purpose of the Interview

The conversation aimed to:

- Highlight the importance of financial literacy for young adults.

- Share Jerron Duhon’s personal journey from Lake Charles, Louisiana, to Yale University and into holistic financial planning.

- Promote his book “The Purpose of Paper”, which focuses on building generational wealth and breaking harmful financial habits.

Key Takeaways

-

Personal Journey & Identity Shift

- Jerron used football as a “meal ticket” to escape his hometown, but a concussion ended his athletic career, causing an identity crisis.

- He pivoted toward financial education and wealth creation, emphasizing long-term planning.

-

Misconceptions About Wealth

- Many young adults believe wealth comes quickly through gambling, sports betting, or flashy investments.

- Social media fuels the desire to display wealth rather than build wealth, leading to poor financial decisions.

-

Financial Habits & Framework

- Jerron introduced his AIMS framework:

- Awareness: Know your current financial state.

- Intention: Set clear goals and reverse-engineer steps.

- Mindset Change: Focus on future self, not old habits.

- Systems: Automate savings and investments to reduce reliance on willpower.

- Jerron introduced his AIMS framework:

-

Faith and Finance Connection

- Principles like self-control, patience, and hope—fruits of the spirit—are essential for financial discipline.

- “Faith without works is dead” applies to money: belief must be paired with action.

-

Generational Wealth

- Gerron stresses taking ownership of your financial future rather than leaving the burden to your children.

- Investing should be strategic and long-term, not like playing the lottery.

-

Practical Advice

- Start small but consistent (e.g., $150/month).

- Use modern tools like Robinhood for stock investing.

- Shift from being a consumer to an owner (invest in companies you use).

Notable Quotes

- “Football was my meal ticket… but I realized I didn’t dream far enough.”

- “We connect our financial decisions to display wealth instead of to build wealth.”

- “Faith without works is dead—just like in finances.”

- “Are you going to be the one that changes your generation, or will you leave that pressure on your children?”

- “Good advice is timeless.”

#SHMS #STRAW #BEST

See omnystudio.com/listener for privacy information.

Todavía no hay opiniones