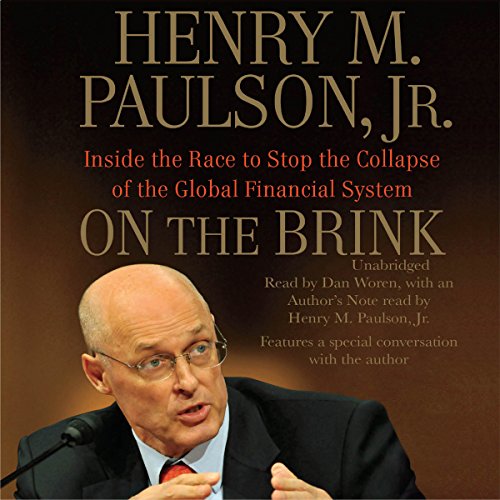

On the Brink

Inside the Race to Stop the Collapse of the Global Financial System

Failed to add items

Sorry, we are unable to add the item because your shopping cart is already at capacity.

Add to Cart failed.

Please try again later

Add to Wish List failed.

Please try again later

Remove from wishlist failed.

Please try again later

Adding to library failed

Please try again

Follow podcast failed

Please try again

Unfollow podcast failed

Please try again

$0.00 for first 30 days

LIMITED TIME OFFER

Get 3 months for $0.99/mo

Offer ends January 29, 2026 11:59pm PT

Prime members: New to Audible? Get 2 free audiobooks during trial.

Prime members: New to Audible? Get 2 free audiobooks during trial.

Just $0.99/mo for your first 3 months of Audible Premium Plus.

1 audiobook per month of your choice from our unparalleled catalog.

Listen all you want to thousands of included audiobooks, podcasts, and Originals.

Auto-renews at $14.95/mo after 3 months. Cancel anytime.

Pick 1 audiobook a month from our unmatched collection.

Unlimited access to our all-you-can listen catalog of 150K+ audiobooks and podcasts.

Access exclusive sales and deals.

Premium Plus auto-renews for $14.95/mo after 30 days. Cancel anytime.

Buy for $28.79

-

Narrated by:

-

Dan Woren

But Paulson had no idea that a year later, he would find himself at the very epicenter of the world's most cataclysmic financial crisis since the Great Depression. Major institutions including Bear Stearns, Fannie Mae, Freddie Mac, Lehman Brothers, AIG, Merrill Lynch, and Citigroup, among others-all steeped in rich, longstanding tradition-literally teetered at the edge of collapse. Panic ensnared international markets. Worst of all, the credit crisis spread to all parts of the U.S. economy and grew more ominous with each passing day, destroying jobs across America and undermining the financial security millions of families had spent their lifetimes building.

This was truly a once-in-a-lifetime economic nightmare. Events no one had thought possible were happening in quick succession, and people all over the globe were terrified that the continuing downward spiral would bring unprecedented chaos. All eyes turned to the United States Treasury Secretary to avert the disaster.

This, then, is Hank Paulson's first-person account. From the man who was in the very middle of this perfect economic storm, On the Brink is Paulson's fast-paced retelling of the key decisions that had to be made with lightning speed. Paulson puts the reader in the room for all the intense moments as he addressed urgent market conditions, weighed critical decisions, and debated policy and economic considerations with of all the notable players-including the CEOs of top Wall Street firms as well as Ben Bernanke, Timothy Geithner, Sheila Bair, Nancy Pelosi, Barney Frank, presidential candidates Barack Obama and John McCain, and then-President George W. Bush.

More than an account about numbers and credit risks gone bad, On the Brink is an extraordinary story about people and politics-all brought together during the world's impending financial Armageddon.

Listeners also enjoyed...

People who viewed this also viewed...

best book i have listened to

Something went wrong. Please try again in a few minutes.

Firsthand insight on the 2007-08 financial debace

Something went wrong. Please try again in a few minutes.

A must listen

Something went wrong. Please try again in a few minutes.

It shed light on some parts of the Financial Crisis but overall it was unfulfilling in that it did not identify the cause of the root cause or the culprits. Paulson rosy picture of how most people acted with ulterior motives for the good of the country sounds hollow and jingoistic.

Paulson assertion that AIG and others had to be bailed out to save "main street" is never substantiated and is hard to believe. Many have credibly argued that the bail out was of Wall street (the perpetrators of the problem) at huge cost to the tax payer.

Largely because of the Financial Crisis, the Federal debt has recently hit $19Trillion

- THIS IS A MINDBLOWING BIG NUMBER.

As soon as an American is born he is immediately in debt to the tune of about $58,000.

America is on the same road as Greece; Greece is just a little ahead.

The book was written in 2009 - it would interesting to know if Paulson has any additional thought now.

INTERESTING - BUT IS IT A WHITE WASH?

Something went wrong. Please try again in a few minutes.

Great book for a layman to understand

Something went wrong. Please try again in a few minutes.